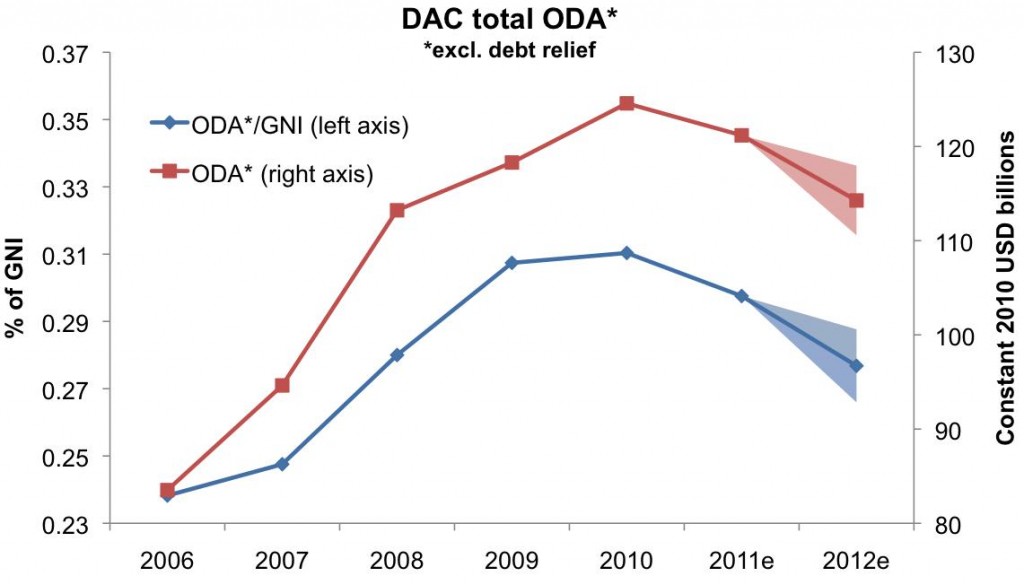

The decade from 2001-2010 saw an aid boom, with aid increasing from about $80 billion to about $130 billion over this period (in constant 2010 USD). In the wake of the 2008 financial crisis, aid initially seemed remarkably robust.

But foreign aid budgets of donor countries are now coming under pressure from austerity measures, lower than predicted economic growth, and calls to reduce “unnecessary” spending. The OECD has recently released data on Official Development Assistance (ODA) for 2011, showing a 3% decline after inflation from 2010. Our analysis of 2012 budget documents, contained in this new Devpolicy brief [pdf], suggests that more cuts are on their way, and that this is indeed the end of the aid boom.

This blog summarizes our main findings and, with the Australian budget to be brought down on May 8, explores the implications for Australian aid.

Country analysis

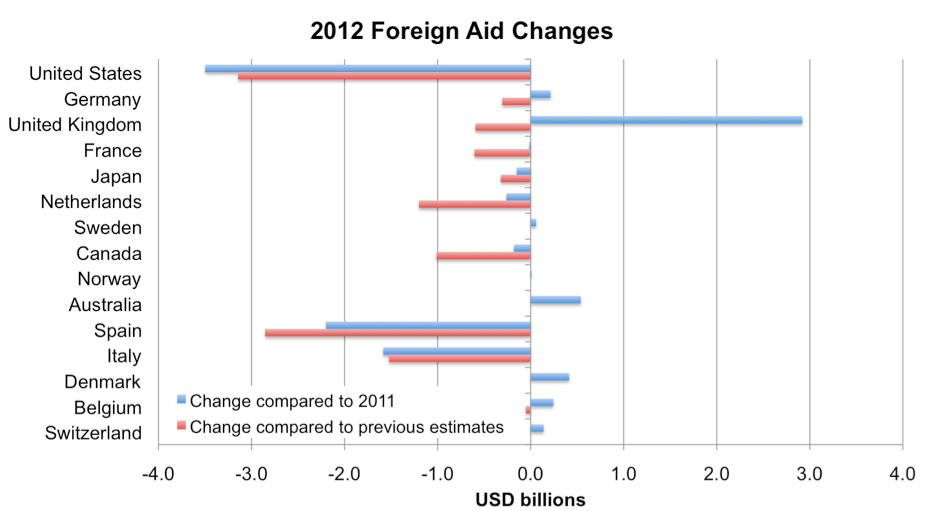

This figure shows, for the 15 biggest OECD (rich-country) donors, 2012 aid budget figures and estimates (using the closest fiscal year) relative to both 2011 and earlier estimates. These are imprecise estimates and comparisons, but the most recent that are available.

There are some huge cuts in the offing. Overall, our best estimate for the United States, the world’s biggest donor, is a 2012 aid reduction of $3.5 billion.

Spain and Italy are implementing devastating cuts to foreign aid. Spanish aid is expected to decline from 0.4% in 2011 to 0.19% of GNI (Gross National Income) in 2012, as its aid agency has had its €900 million budget slashed to €380 million [pdf, pg 95]. The budget of Italy’s Directorate General for Development Cooperation has been reduced by 88% since 2008 to €166 million in 2011 and a modest €86 million in 2012.

Other cutbacks are less dramatic, but no less important. Canada has abandoned its plans to scale-up aid by 8% each year, instead aiming to shrink the budget 7% by 2015. The Netherlands has cut 2012 aid to €4,420 million, €917 million less than previous estimates, corresponding to a decline from 0.8% to 0.7% of GNI.

The 15 aid budgets we considered together forecast 2012 aid spending at $3.4 billion less than in 2011. Adjusting for inflation, the real value of this year’s aid budgets for the top 15 donors is 4.9% less then in 2011. Only Australia, Belgium, Denmark, Switzerland, and the UK are expected to increase aid in 2012 by more than inflation.

We can also compare the most recent estimates for 2012 aid spending to projections donors themselves made in 2010 or early 2011. This year, aid agencies in the top 15 donor countries will receive as much as $12 billion less (in current dollars) than they would have anticipated based on their own governments’ earlier strategy and budget documents. This $12 billion discrepancy is much greater than the $3.4 billion cut from 2011 because several countries which did not reduce their absolute aid levels nevertheless abandoned their plans to scale up aid.

The figure below summarizes our estimates for aid in 2012 compared to historical spending, in constant 2010 dollars. To make our estimates comparable with historical data, debt relief has been excluded from aid or Official Development Assistance (ODA) figures. To allow for uncertainty in calibrating 2011 budget items for the top 15 donors to historical ODA volumes from all donors, we present a range of estimates. (For more detail on methodology, see the policy brief [pdf]). Our best estimate is that OECD aid (excluding debt relief) in 2012 is about $114 billion or about 0.28% of total OECD GNI, its lowest level since 2008.

Filling the gap?

Aid from non-OECD donors (such as China and Brazil) is significant and growing, but it is still small compared to OECD aid. One estimate [pdf] puts it at about $10 billion. Over the longer term, increasing aid volumes from emerging donors may well fill gaps left by OECD donors, but not in the next few years.

What about philanthropy? Global philanthropy has also been on the rise. But, sensitive to economic hardship and worth less than half of total ODA [pdf], in the short term changes in private giving are unlikely to offset government aid cuts.

Implications for Australia

The UK – with its commitment to increase ODA to 0.7% of GNI by 2013 – and Australia – with its commitment to increase ODA to 0.5% of GNI by 2015 – are the two countries doing the most to help mitigate the recent and projected cuts to global aid.

The figures in our brief and this post cover Australia up to the current fiscal year July 2011-June 2012. What will happen to Australian aid next year is currently a matter of much speculation in the run up to the May 8 2012-13 budget. Australia is in fact particularly strongly positioned to help shore up global aid. As a country which is not suffering fiscal stress and has benefited greatly from the resource boom, we can afford to give more. As a country which is still well below average in terms of aid generosity (12th out of 15 in terms of aid/GNI for the major donors), we should give more. And as a country with an “improvable but good” aid program, our aid will make a difference.

The Global Fund’s money woes are well known. Other agencies and countries reliant on the aid dollar will also face cutbacks. Not all aid is well spent, but ultimately the end to the aid boom has to be expected to hurt the world’s poorest. Now more than ever, to help fill emerging global aid gaps, we need more and more effective Australian aid.

This blog is part of a series on 2012 Aid Budgets. For other blogs in the series, see here.

Kathryn Zealand is a Researcher for the Development Policy Centre. Stephen Howes is the Director of the Centre.

Many bilateral aid programs are fragmented and are used as a way of getting business for national firms. They have not done well in international evaluations, so maybe these cutbacks will not have as great an impact as feared.

Kathryn and Stephen,

This is an intricate and interesting piece of crystal-ball gazing. It is, of course, not the only attempt to predict global aid aggregates for 2012 and beyond. Reporting and forecasting aid flows is core business for the OECD Development Cooperation Directorate, whose statistics division has been thinking about the best way to do this, and conducting surveys of donors’ forward spending plans, for some time. With that in mind, I make the following four comments.

First, some aid cuts matter less than others. For this reason, the OECD has, over time, developed the unhappily-named concept of “country programmable aid”, which is an attempt to weed out flows that are considered generally not to deliver significant direct benefits to developing countries, such as aid administration costs, eligible spending on refugees in donor countries and debt cancellation. The concept is meant to get at what is “core” aid, or perhaps “available” aid from a developing country perspective. Your policy brief does remove some categories of flow for the purposes of cross-donor comparison – accounting, you indicate, for about 17 per cent of Official Development Assistance (ODA). However, it still includes much that is excluded by the concept of country programmable aid, which excludes on average half of total ODA. Consequently, the actual impact on developing countries of the decline you predict may be less than is implied.

Second, what donors spend is less important than what developing countries receive. Even if, contrary to the first point above, all ODA lost was equally mourned, ODA is essentially a measure of donor effort (outflows from donor coffers, either to developing countries or to multilateral organisations) rather than a measure of developing country aid receipts. This might seem an overly subtle point but the money that goes into multilateral organisations, particularly as contributions to replenishments of the multilateral development banks’ concessional financing arms, can take a good while to come out – hence the use by the OECD of another opaquely-named concept – “Official Development Finance” – as a measure of the development financing that is actually received by developing countries in a given year (see, for example, Table B.4 in the OECD’s 2011 Development Cooperation Report). Hence, also, the decision to use concessional outflows from multilateral organisations, rather than ODA inflows to them, in calculating country programmable aid. The latter is not merely ODA more narrowly defined; it is more like aid viewed from the receiving end.

Third, ODA, private investment and remittances aren’t quite the whole story. Less-concessional official development finance (which is included in the official development finance measure just mentioned) has been small or negative in net terms for much of the last decade, but increased in importance as the multilateral development banks scaled up lending in the post-crisis period. While this category of flow is not relevant to low-income countries, it is relevant to the growing group of middle-income countries that contain the majority of the world’s poor. Trends in less-concessional official development finance matter, along with trends in private investment and remittances.

Fourth, the outlook for aid might look very different depending on whether it is viewed from the giving or the receiving end. Putting together the first and second of the points above, what seems to be of most interest is how much country programmable aid might actually be received by developing countries in 2012, and how that might compare to the same figure in 2011. And in fact the OECD has, a month ago, released preliminary findings on exactly this, drawing on early results from a donor survey of spending intentions for the period 2012 to 2015 (final results are due out in June 2012). That survey finds that while country programmable aid declined by 2.4 per cent in real terms from 2010 to 2011, it looks likely to recover in 2012, with about a six per cent real increase. However, this is almost entirely a result of anticipated increases in concessional lending by the multilateral development banks, flowing from recent replenishments (exemplifying the lag mentioned in the second point above). After 2012, it is expected that country programmable aid will remain flat or slightly decline.

In short, the stated spending intentions of bilateral donors might be a reasonable basis for predicting what 2012’s global ODA aggregate will look like, but ODA doesn’t include all financing for development and not all ODA is necessarily experienced as financing for development by developing countries. It would seem desirable to adopt something like the concept of country programmable aid, which removes less relevant flows and takes account of outflows from multilateral organisations, and also to track what is happening with less-concessional official development financing as well as private investment and remittances, if we are to get a better fix on the real implications of falls, or for that matter rises, in ODA budgets.

Robin,

Many thanks for this comment. We did in an earlier draft of the brief have a comparison with the recent (http://www.oecd.org/dataoecd/45/25/50056866.pdf) OECD projections using country programmable aid (CPA) but in the end decided to omit it for reasons of length and complexity. Perhaps that was a mistake.

The OECD analysis is much more optimistic than ours. It projects an increase in bilateral CPA in 2012 of some 3% in real terms. By contrast, we estimate cuts in ODA for 2012 of 2.3% before inflation and 4.7% after inflation. Perhaps bilaterals will respond to their own aid cuts, as we suggest, by heavily cutting multilateral contributions, but even then it seems hard to believe that bilateral aid will rise in 2012.

It is not clear why these two exercises give such different results. I don’t know when the survey on which the OECD analysis is based was undertaken, but my hunch would be that it might have been overtaken by events. The recent round of budget cuts to aid have come as a surprise.

As to whether analysis should be undertaken in terms of ODA, CPA (a subset of ODA for bilateral donors, plus multilateral concessional aid), or, as you suggest, by also looking at other non-concessional official financing, these are surely all relevant. But aid (ODA) is a reasonably well-defined and important aggregate to track. And there has been an aid boom over the last decade. Last year (2011) saw positive nominal growth in aid, but not enough to keep up with inflation. Our finding that aid (ODA) in 2012 is actually going to fall in nominal terms is important enough to justify the analysis. It shows that not only has the aid boom come to an end, but that aid is now on the decline.

Thanks Robin for the comment,

Our central point is to do with donor generosity.

It is true that recipient countries might not feel the true force of these cuts, at least not immediately. However, we mostly wanted to highlight that globally donors seem to be viewing their aid programs as expendable, with a few rare exceptions. Even in countries which haven’t cut dramatically aid, there are grumblings of discontent and politicians are distancing themselves from aid commitments.

When was it decided that aid to the world’s poorest should be the first to go when things at home get tough?