We know that labour mobility is key for development in the Pacific and already an important source of foreign exchange earnings and household income for some Pacific island countries. But for Pacific workers in Australia or New Zealand wishing to send money home, remittance transaction costs are among the highest in the world and there has been no success in recent years in bringing them down. The Australia-PNG corridor, in particular, stands out as one of the most expensive in the world.

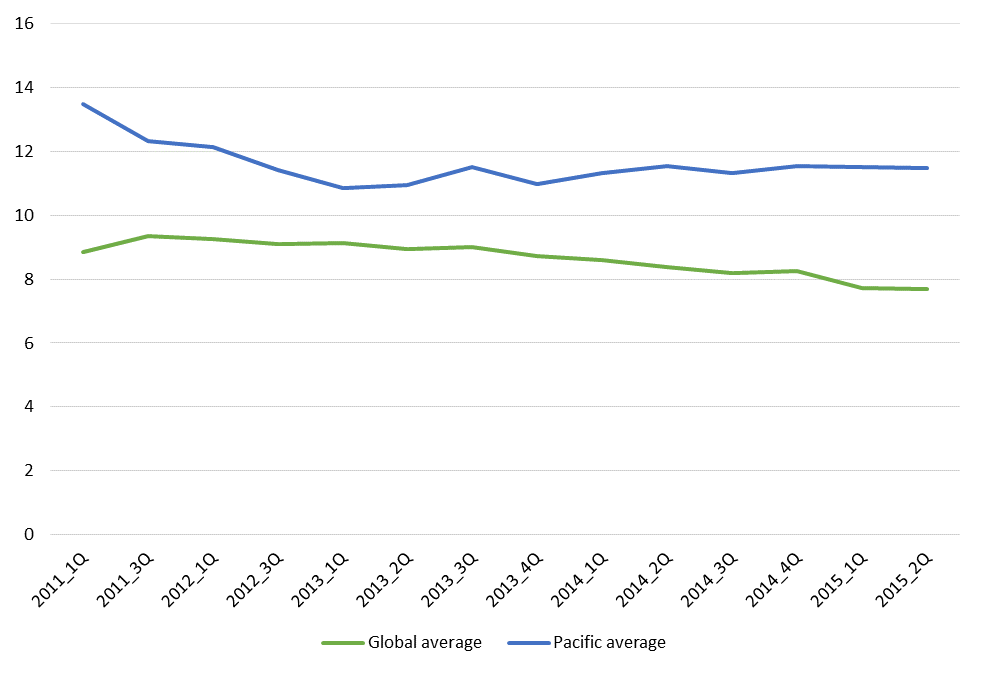

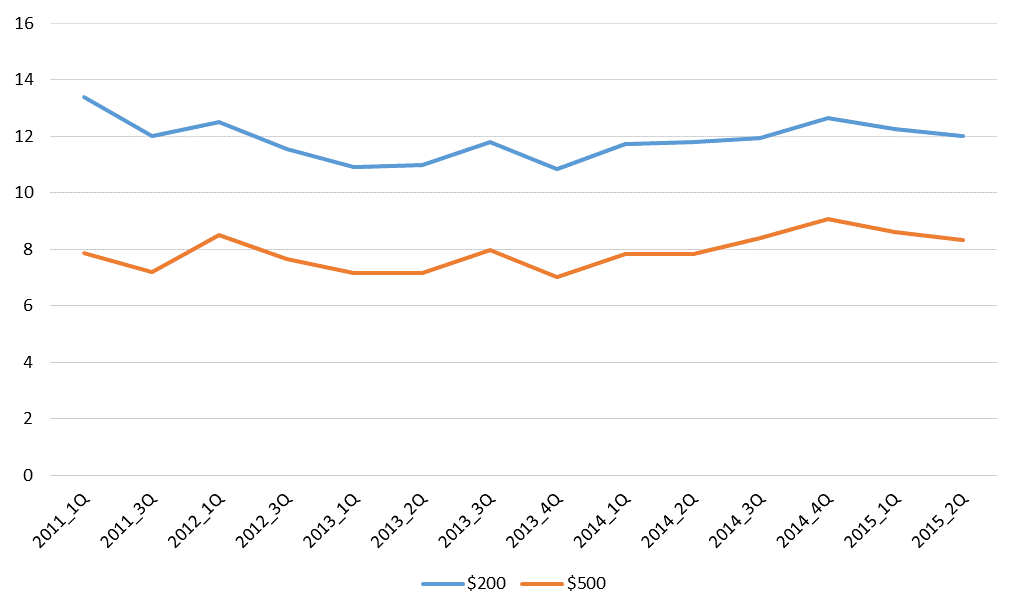

Globally, the average cost of sending remittances is currently at 7.5% (based, by convention, on the cost of sending $200). The global average cost remains above the G20 target of 5% and way above the more demanding SDG target of just 3%. The cost of remitting from Australia to anywhere is comparatively high, at an average of 9.2%. The cost of sending remittances to the Pacific from either Australia or New Zealand is substantially higher again at 11.5%. Worryingly, whereas the global average cost of remitting has been falling, there has been no progress in reducing average costs in the Pacific for at least the last two years. There was some reduction in costs for sending $200 prior to 2012, but none since, and no progress at all since 2011 in reducing the costs of transacting a larger amount of $500.

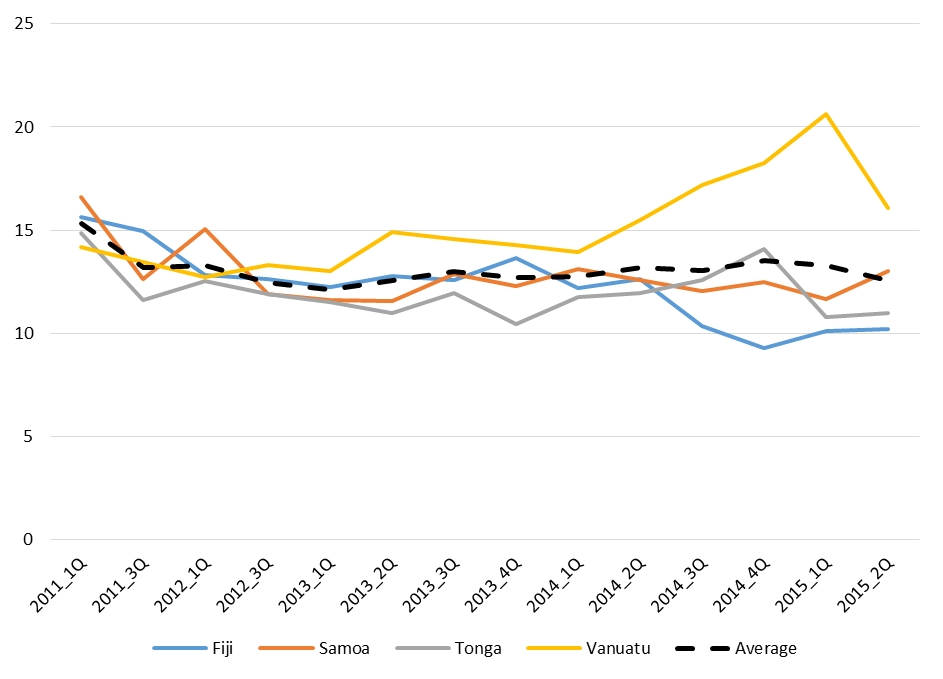

The two charts below draw on the World Bank’s Remittances Prices Worldwide (RPW) database. The costs include both fees, and any difference between the exchange rate provided by the money transfer operator and the interbank exchange rate.

Figure 1: Global and Pacific average percentage cost for transferring $200

Figure 2: Global and Pacific average percentage cost for transferring $500

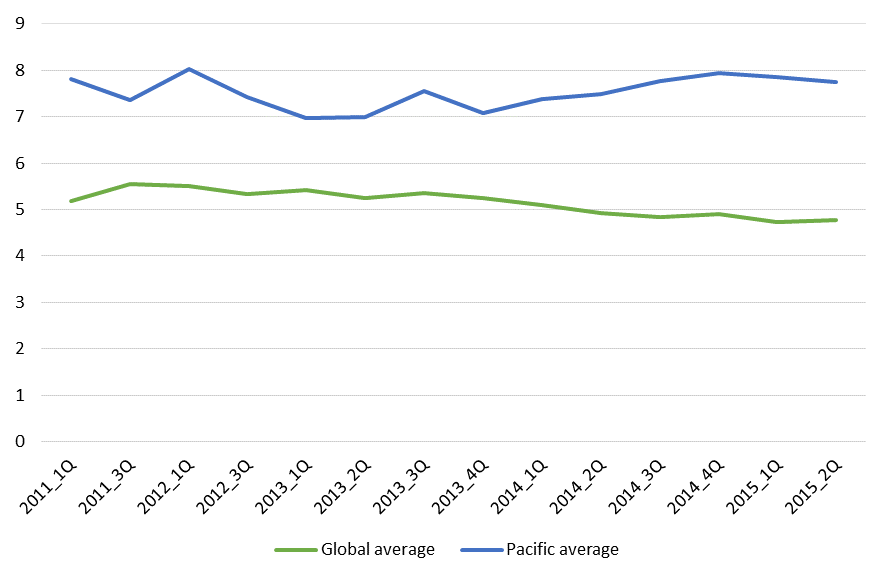

The cost of sending money is particularly high from Australia, as the chart below shows, via comparison with New Zealand.

Figure 3: Average percentage cost to send $200 or $500 to the Pacific from Australia or New Zealand

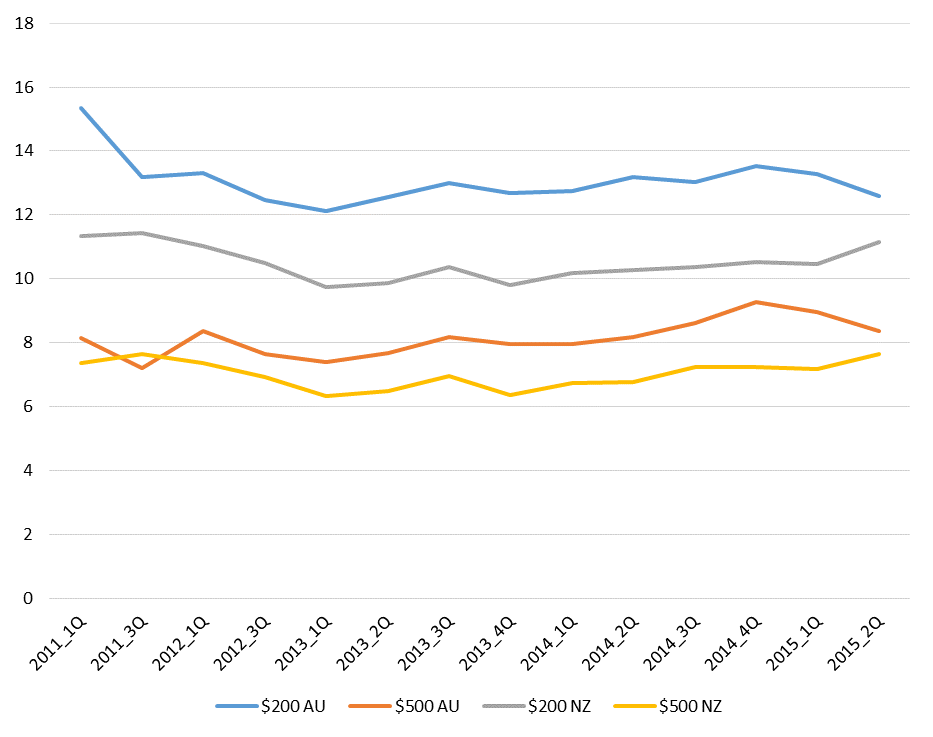

The RPW database contains quarterly information on transaction costs since 2011 for sending money to Tonga, Vanuatu, Fiji and Samoa from both Australia and New Zealand. This is the data used to calculate the “Pacific averages” shown in the charts above. The figure below shows costs separately for the four countries. Only Fiji’s costs have been on a consistently downward trend. Vanuatu seems to be trending up.

Figure 4: Average percentage cost for sending $200 from Australia to Pacific island countries

Indeed, if we take Fiji out, it becomes clear that costs have in recent years been stable or increasing for the other three Pacific countries.

Figure 5: Average percentage cost of sending $200 and $500 to Pacific island countries other than Fiji (Australia and NZ combined average)

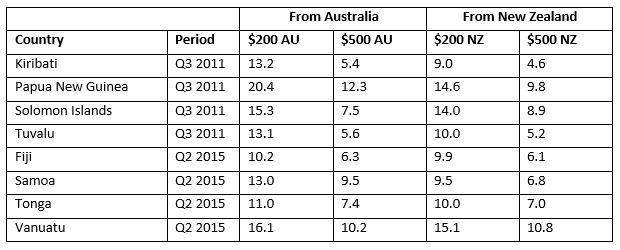

While the time series data is only available for four Pacific countries, data from 2011 is available for a larger number. The table below shows the average percentage cost across money transfer operators for the most recent period available for each country. Melanesian countries fare particularly poorly, possibly due to their lower numbers in Australia and New Zealand when compared to workers from Polynesia. PNG is the most expensive destination, followed by Solomon Islands and Vanuatu. If you want to send $200 home from Australia to PNG, it will cost you $40 just in fees!

Table 1: Cost of transferring money from Australia or New Zealand to Pacific island countries as a percentage of total transfer – latest available period

Reducing remittance costs has been a long-held objective of the Australian Government. In 2009, the Australian and NZ aid programs financed a new website, Send Money Pacific, which allows people to compare costs across sending options. Similar websites have been financed by other donors in other regions. In 2011, the then foreign minister Kevin Rudd announced a Commonwealth-wide initiative to reduce such costs, including in the Pacific. In the G20 context, the Australian Government highlights (Annex 1) a range of actions that it is taking to reduce the cost of remittances, especially in the Pacific. The government’s heavily advertised partnerships with ANZ and Westpac might also have been expected to involve some action on remittance costs. Clearly, these various measures aren’t working.

More research is needed to understand why. Worldwide, there are concerns that anti-money laundering policies are pushing up remittance costs. These same worries were expressed in the Pacific context at the recent Forum Economic Ministers Meeting in Cook Islands where Ministers “expressed with ongoing concern the increased costs associated with the wholesale closure of bank accounts of Money Transfer Operators (MTOs) and their Agents.”

But tighter anti-money laundering policies can’t on their own explain the widening gap between the cost of sending Pacific and worldwide remittances, nor why the former is stagnant, while the latter continues to decline.

Ashlee Betteridge is a Research Officer at the Development Policy Centre. Stephen Howes is Director of the Centre.

Notes: The RPW survey covers two amounts per corridor–the local currency equivalent of $200, and the local currency equivalent of $500. All dollars referred to are US dollars. Further details on the RPW database methodology are available here. The global average is calculated as the simple average of the total cost of remitting across all money transfer operators. The Pacific average (and the Pacific average excluding Fiji) has been calculated using the same method. Some Q3 2015 data is now available on the RPW website. The data is not complete enough to include in this post, but it suggests a significant drop in costs in transferring funds from New Zealand to Pacific island countries, but only a marginal drop in costs from Australia. As the figures in this post show, there is significant quarter-on-quarter volatility. A spreadsheet with the data used in the figures above is available here.

Regarding cost of international transfers, here is an example from my experience.

One agency situated in a particular Pacific Islands country donated USD 100K equivalent in the local currency to a development project involving partners in multiple regional countries. A USD bank account was set up in the host country of the project’s organisation. The 100K in the local currency of the orginiating country was transmitted as a TT to this account. What arrived was 88K. So 12% or USD 12,000 was taken by the banking system in one transaction – in a matter of seconds. That is probably not a particularly extreme case.

Thank you for raising an issue of great concern, not only among Pacific Island employees in Aust and NZ but also students who also have the added responsibility of supporting families back home with their limited scholarship allowances.

There are other financial inequalities that conspire against a level playing field for Pacific Islanders. The Internet always promised to reduce the “tyranny of distance”, providing the remote scattered island communities with new opportunities arising from globalisation.

However in Solomon Islands where I live, and probably other regional countries, would be online businesses, eco-tourism operators and artisanal traders still lack access to online payment systems that support local bank accounts. Telegraphic transfers are not suitable as a general payment system for many reasons, they are expensive and thus prohibit small transactions, and customers expect one-click purchasing.

The only real contender owing to it’s ubiquity is Paypal. However, it does not support local bank accounts here. This means that Solomon Islanders cannot offer it to their customers as payment system. As far as I know there are no other online payment systems that are as accessible as Paypal that would be available to local people here.

For those expatriates and elites who have access to offshore accounts this is no problem. But why is this service – a normal aspect of commercial life in most of the world – not available here?

Some time ago I asked Paypal online help about this and received the rather generic reply:

“I understand that you want to know why adding a Solomon Islands commercial bank account can’t be added to a Solomon Islander PayPal account. Due to the challenges and complexities associated with the worldwide financial network, we cannot offer the option to add a Solomon Islands commercial bank account to a Solomon Islander PayPal account. We also cannot offer a firm date or timetable for expansion of specific services.”

One possibility is that commercial banks here are resisting the introduction of such services. It is certainly true that banking services here are generally second rate compared to what the same banks offer in Australia and New Zealand.

If we want true financial inclusion it has to be on equal terms with dominant economic powers. Over several years I have brought this question up in online forums such as the Pacific Chapter of the Internet Society, and with contacts in our Central Bank for instance, but there is no change in the situation.

Hi David,

You may be interested to learn of a new operator serving Australia and New Zealand to the Solomon Islands. They will be covered in the next http://www.sendmoneypacific.org data collection in December and will then be listed on the website’s comparison tables. There is information about their service in the Solomon Islands news section of the website.

Best,

Jonathan

Do you know if any (and how many) remittances might possibly use bitcoin or cryptocurrencies? Or is this not really feasible for the pacific? See this article from last year. And this.

There was a lot about this option in 2014 but I have not seen so much this year.

Hi Ashlee and Stephen,

Many thanks for your blog. It’s great to see the Pacific remittances issue receiving due attention.

My company, Developing Market Associates (www.developingmarkets.com), on behalf of DFAT and MFAT, manage the SendMoneyPacific (www.sendmoneypacific.org) website that you have referenced. Over the past seven years we have recorded an overall reduction in cost but not to the extent that we would have liked – i.e. attaining the G20 5% remittance target.

However what we have seen over the past seven years are significant cost reductions in the higher volume, more competitive corridors to Fiji, Samoa and Tonga that are dominated by Money Transfer Operators (MTO’s) rather than bank dominated (such as PNG which you have focused on). Bank costs have barely changed over the six years we have monitored costs, falling by just 2% (to 18.1%) by June 2015. MTO costs on the other hand have fallen by almost 35%, and for some of the most competitive/high volume corridors by over 50% for sending AUD/NZD 200 (e.g. Australia to Fiji: 17.99% in January 2009 to 8.24% in June 2015; NZ – Tonga: costs down 57% from 16.25% to 6.99%). For these competitive corridors, MTO costs are now approaching 5% for sending $200. For AUD/NZD 500 transfers, MTO costs are now below 5% for NZ – Samoa and Tonga, and at 3.79% for Australia – Tonga.

Cost variations between providers for the same corridor continue to be very significant. The latest data for November for Australia – Samoa (AUD 200) reports a range between 2.59% to 26.99% – the difference between receiving WST 360 and WST 276 for the same value transfer!

A further significant development in recent years has been the increase in available digital remittance services, particularly services paying out to mobile wallets in Fiji, PNG, Samoa and Solomon Islands. Since 2012, digital MTO services have doubled, from 17 to 34, across the 16 corridors covered from Australia and New Zealand. The growth in digital MTO services comes at a critical time during a fraught period for MTOs in Australia and New Zealand as they face operating difficulties or in some instances, closure, due to the de-risking issue.

Unfortunately at this stage there is limited disclosed data on the actual volumes being sent via digital services, rather than traditional cash based MTO services and bank transfers. However, there is anecdotal information, via the surveys we conduct for SendMoneyPacific, seasonal worker surveys and interviews, and other communication that we regularly have with Pacific Diaspora communities through our outreach programmes for SMP, that Pacific remittance senders are increasingly using digital services.

Please feel free to get in touch if you would like to explore the different services used by Pacific remitters that I have highlighted. We will also shortly be completing Q4 data collection and analysis.

Many thanks,

Jonathan

[These comments reflect personal views and do not in any way represent official positions of the NZ Government]

Hi Ashlee and Stephen,

I think there are a few factors at play. On your question about why Pacific costs are stagnant relative to global declines, a lot of that “inertia” in price movements in the Pacific is probably explained by structural constraints such as low scale and volume. Other things constant, compared to the Saudi Arabia / UAE – Phillippines corridor or the UK – Nigeria corridor remittances from A/NZ to the Pacific are always likely to be more expensive.

Many global innovations, especially electronic platforms that more efficient and effective “bunching” of smaller remittance transactions by remittance service providers, have had an impact in the Pacific (especially if you move your data set out a few years before 2011). But ultimately they face the same structural constraints – larger corridors can “bunch” more volumes, so they end up benefitting more from these solutions in relative terms to the Pacific.

There are also strucutral banking constraints, such as high fees relative to other high-volume corridors. For money to move across borders, especially in the Pacific, most (but not all – e.g. Western Union) remittance service providers still need a financial institution to do that for them (most often a bank) that is a member of the SWIFT transfer system.

The impact of regulatory issues is still uncertain, and it will be interesting to see the results of the World Bank’s G20 survey on de-risking. Regulators seem to be taking this issue seriously, with a number of global regulators and coordinating bodies issuing statements commiting to investigate the extent to which regulatory settings may be affecting the remittance services market.

It’s great to see reimttances get some airtime on the blog – there’s a lot more we could be doing to discuss and understand this issue.

Cheers

Vinny