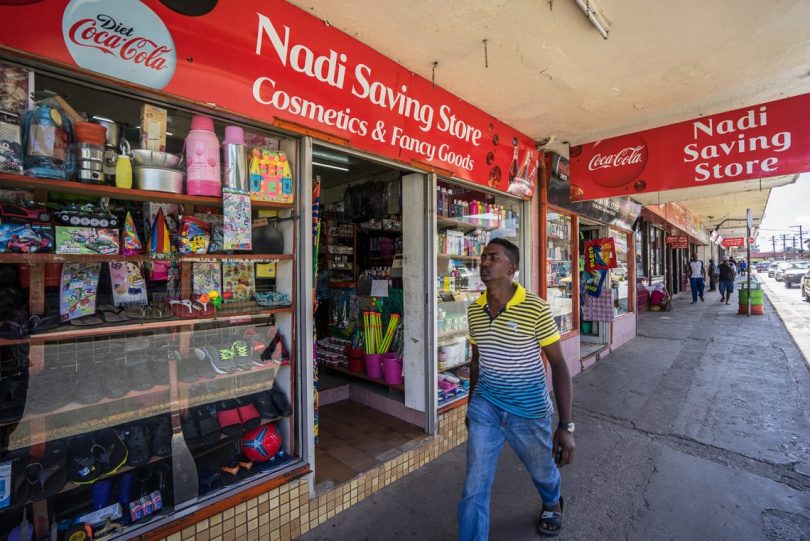

The COVID-19 pandemic presents an exceptional threat to the economies of Pacific island countries (PICs). While both large and small businesses are facing very significant challenges in the wake of COVID-19, the threat will be acute for many micro-, small- and medium-sized enterprises (MSMEs) in the Pacific. The survival of MSMEs is essential not only for Pacific employment and production but also for the development of competition, which is crucial for consumer welfare and long-term economic growth.

Business activity in PICs is dominated by state-owned enterprises and a small number of multinational businesses. MSMEs comprise the great majority of businesses, by number, and employ a large proportion of the workforce. MSMEs that are active in the formal economy are important agents by which competition enters monopolised markets. It is the incorporated MSMEs, trading in the formal economy, that first bring competition to the large, vertically integrated and monopolistic suppliers. In PICs, markets for many goods and services exhibit little or no competition, so the dominant supplier faces little or no pressure to improve its products, delivery or pricing. Such competitive pressure drives economic efficiency and consumer welfare. Temporary measures that respond to the difficulties confronting MSMEs will help to preserve the competition that is emerging but still fragile in many Pacific markets.

COVID-19 pandemic restrictions, and post-pandemic trading conditions, will jeopardise the solvency of many MSMEs, especially those that operate in directly affected economic sectors such as tourism, retail and hospitality. The threats now confronting MSMEs include: increased insolvency risks (as costs such as rent remain fixed while income is falling); heightened contractual default risks (as suppliers and customers struggle with their own constraints); new compliance costs; staffing challenges; and heightened uncertainty in trading conditions.

Interim financial support is MSMEs’ most urgent and obvious need but is unlikely, by itself, to ensure their continuing viability. PICs must also consider complementary forms of non-financial support for MSMEs. This article focuses on measures that will support those MSMEs that are formally incorporated. Most PICs have in place laws designed to protect those who invest in or trade with companies. Such laws play an important economic role but, in the exceptional circumstances following the recent crisis, present a hazard to incorporated MSMEs and their directors and are likely to inhibit business recovery. Governments should consider the temporary relaxation of such safeguards.

Enabling use of electronic media

Online meetings and electronic communications have enabled many businesses to carry on despite restrictions on travel and personal contact. Many companies’ constitutions or internal rules do not permit the use of electronic media to hold general meetings, make resolutions, sign documents, or give notices. Governments can enact legislation authorising companies’ use of electronic communications so that company governance can proceed.

Leniency in bankruptcy thresholds

While businesses that have otherwise been able to meet their debts are reeling from the impact of COVID-19, governments should consider adopting less stringent thresholds under bankruptcy and insolvency laws. For example, in Australia the minimum threshold at which creditors can serve a formal statutory demand on a company has increased from A$2,000 to A$20,000 for a period of six months, and companies have six months to respond to a statutory demand rather than the previous 21 days.

The object of such changes is to give affected businesses a better opportunity to continue trading before they are exposed to liquidation or winding up.

Protecting directors from liability

Under normal circumstances, a range of duties are imposed on the directors of companies for the protection of their shareholders and the public. These typically include a duty not to permit the company to continue to trade while it is insolvent. Directors can be held personally liable for a breach of their duties, and a liquidator or creditor of the company can apply to a court to recover their loss or damage from a director or former director.

Australia has recently suspended for six months directors’ personal liability for insolvent trading, where the debts are incurred in the ordinary course of business and in good faith, and the losses are due to the COVID-19 situation. New Zealand has also enacted temporary “safe harbours” for directors from duties regarding reckless trading and ability to meet obligations.

Directors’ duties are essential safeguards under normal circumstances but, in the exceptional circumstances now obtaining, are likely to deter conscientious directors from being involved with a company that continues to trade.

Temporary expansion of Registrars’ discretion

Registrars of Companies can temporarily be given powers to extend deadlines for meetings or reports, reduce fees, or otherwise introduce a degree of leniency. This will encourage continued regulatory compliance and reduce the risk of penalties becoming an additional burden on struggling businesses.

Conclusion

The COVID-19 pandemic and post-pandemic conditions present serious challenges for the Pacific region’s MSMEs. Their survival is crucial to PICs’ economic development objectives, however, as MSMEs make up the majority of businesses and are the means by which competition emerges in goods and services markets.

Governments can improve the chances for survival of incorporated MSMEs by temporarily relaxing obligations (such as the duty to avoid insolvent trading) that are designed for the protection of investors and the public. A combination of temporary amendments to company and insolvency legislation, and temporary extension of the discretion of Companies Registrars are practical steps.

This post is part of the #COVID-19 and the Pacific series.

Leave a Comment