The world is now less than one year out from the next big International Conference on Financing for Development to be hosted by Spain. It is a truism to say that the gap between the world’s development and climate challenges and the global policy and finance settings needed to address them has grown since the last summit on this topic was held in 2015 in Ethiopia. Many of the 2030 Sustainable Development Goals remain off track and the consensus among scientists is that limiting global warming to 1.5 degrees will now be extremely difficult, if not impossible. The number of people forcibly displaced by conflicts, disasters and persecution increased to over 117 million in 2023. And ongoing outbreaks of zoonotic diseases like bird flu are reminders that the next pandemic may not be as far away as we would like. Sadly, in the words of two prominent development economists, in 2024 “the world is still on fire”.

Far from driving a new development consensus, these challenges are generating a mixture of division, denial and delay. The world now faces the prospect of a stalemate over a new climate finance goal, as developed and developing countries continue to debate its quantum, composition and who should pay. Proposals for modest carbon levies on global industries like shipping to help fund development and climate transitions have been blocked by coalitions of the unwilling comprising developed and developing nations. A proposal from several member countries to push for a global consensus on minimum taxation for billionaires at this year’s G20 summit in Brazil is likely to be met with similar resistance. And one recent assessment suggests that, as at mid-year, less than one-fifth of the global funding needed to alleviate humanitarian suffering in 2024 has been provided.

The paradox is that while the aggregate effects of these challenges are felt globally, our partial and piecemeal system of global governance means that the principal policy levers for addressing them remain at the national level. For developing countries, addressing poverty, inequality and climate change means striking domestic political bargains and crafting institutions that can support economic growth, environmental, and development goals. For developed countries, it requires building a political and public consensus around global issues like trade, security, migration, technology and decarbonisation that can advance long-term interests and manage the big development policy trade-offs that lie beyond the narrow calculations of transactional statecraft.

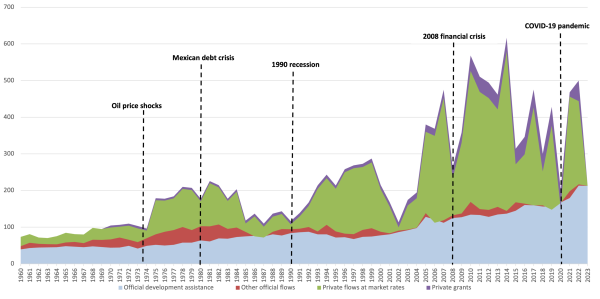

Nonetheless, global cooperation and external development finance – comprising Official Development Assistance (ODA or “aid”), other official flows, philanthropic flows and publicly mobilised private finance – have important roles to play. For all its faults, aid, relative to other flows, has been one of developing countries’ most stable sources of finance during crises since the 1960s (see Figure 1).

Figure 1: total net resource flows from OECD DAC countries to developing countries, 1960–2022 (constant 2022 US$ billion)

Adapted from: OECD DAC (2020), Six decades of ODA: insights and outlook in the COVID-19 crisis. Figures and deflator from 2019 onwards provided by OECD DAC.

And aid has continued to grow in real terms over the last several years, with ODA from OECD Development Assistance Committee (DAC) donors climbing to a record US$224 billion in 2023 on the back of recent crises like COVID-19 and Russia’s invasion of Ukraine. As a combined share of DAC donors’ wealth, over the last two decades aid has increased by over 50 per cent, from 0.24 per cent of their gross national income in 2003 to 0.37 per cent in 2023.

But this is still a far cry from the 0.7 per cent ODA/GNI target first adopted by the UN over fifty years ago, with just five out of 31 DAC donors meeting or exceeding this target in 2023. In 2022, net financial transfers to developing countries fell to their lowest levels since the Global Financial Crisis with 26 developing countries experiencing negative net transfers as outflows like private debt servicing outstripped inflows, including new development lending and grants.

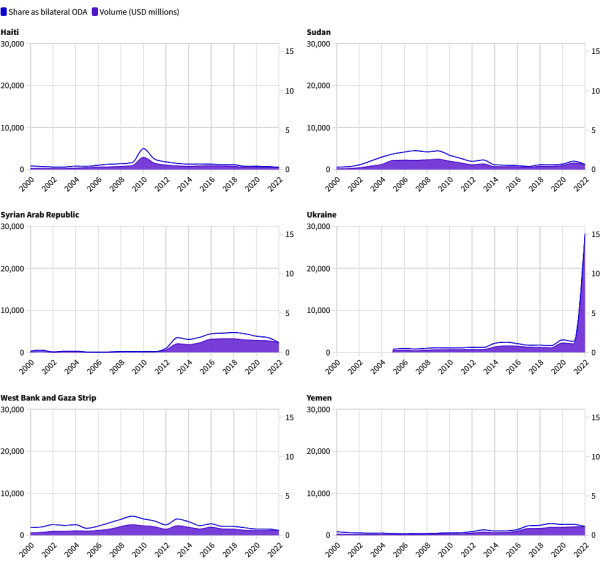

And there are legitimate questions about distribution. Compare, for example, the disparity between the surge in ODA to Ukraine following Russia’s invasion in 2022 and support up to that point for other protracted crises (see Figure 2).

Figure 2: DAC members’ responses to selected crises and conflicts, 2000-2022

Source: OECD (2024), Official development assistance trends in times of crisis. Note: as this data only goes up to 2022, it does not include humanitarian aid provided to Gaza since the beginning of the conflict in October 2023, nor to other crises.

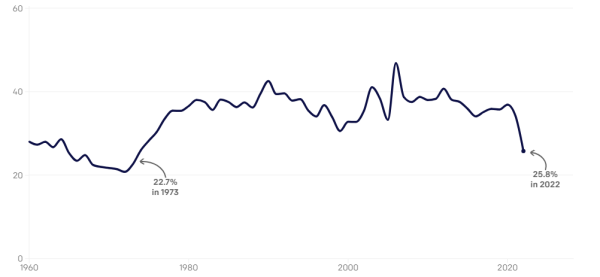

The share of aid from the G7 countries and EU institutions to Africa — which contains the countries with the highest proportions of extreme poverty — fell to its lowest level in almost 50 years in 2022 as these donors have cut bilateral aid or shifted funding to priorities such as Ukraine and domestic refugee support (Figure 3).

Figure 3: share of G7 and EU institutions’ ODA to Africa (%), 1960-2022

Source: One Campaign (2024), G7 share of aid to Africa at lowest level since 1970s

Some Western donors that are cutting aid to Africa have simultaneously complained that China is playing too big a role in the continent’s development, as well as in other regions. But China is also pulling back its finance as it faces its own economic challenges, with its lending to Africa falling to a 20-year low in 2022 and much of this now aimed at protecting its increasingly shaky sovereign debt portfolio.

The misguided promises of “billions to trillions” made by the West when it comes to mobilising private development finance have not been delivered, and according to some experts, never will be. Indeed, there are questions about the extent to which donors are using “private sector instruments” to substitute for genuine fiscal effort and to artificially inflate their aid budgets. In the meantime, these budgets are being plundered and/or “rebadged” to help meet climate finance commitments — which were supposed to be “new and additional” — imposing further costs on climate vulnerable nations.

Intensifying geopolitical competition has made global collective action problems like global health insecurity and climate change even harder. Global development institutions are also increasingly fragmented, with developing countries seeking to emphasise the role of the UN system (and establishing new UN bodies), where they hold a majority. The West, on the other hand, has stressed the primacy of institutions like the G20 and the international financial institutions. Major governance reform of the latter, long overdue, remains difficult due to geo-political gridlock. This, in turn, makes “grand bargains” on issues like aid effectiveness, climate finance and debt restructuring even harder.

The aggregate effect of all of this has been the erosion of trust between the West and many countries in the global south. But China has not automatically benefited from this. It too is coming under increased scrutiny for its intransigence on debt and the quality of its lending, and faces questions about its own climate finance obligations as a large, high emissions economy.

If all this sounds bleak then, sadly, the future doesn’t look much brighter. The rise of the populist far right in Europe and a possible Trump victory in the US in November could deliver new shocks. The EU, collectively, and the US accounted for over two-thirds of global ODA in 2023. A 16% combined reduction in US and European ODA — an illustrative figure that is equivalent to the single year cut that the Abbott government implemented in Australia in 2015 — would rip about US$27 billion from global aid. Multilateral and climate aid would likely be among the primary targets, along with aid for sexual and reproductive health and rights and gender equality.

In the second part of this blog, I will try to take a less bleak tone and take a look at some of the concrete proposals designed to remedy this situation and to improve the prospects for effective development finance.

Read Global development finance – outlook and prospects: Part 2.