The 2012 Fiji Budget was released on November 25. It is the military government’s fifth budget, and is probably its best. The Budget is being handed down in an environment of stagnant economic growth and high government debt. It goes some way in addressing both issues.

The most significant feature of this year’s budget is the very large tax cuts provided to individuals and corporations. These are designed to stimulate economic activity, and are paid for by increasing a number of indirect taxes.

Specific budget measures include:

- Reductions in income tax rates across the board (see table 1). At the same time, a scaled “Social Responsibility Levy” is being introduced for those with incomes over FJ$270,000, beginning at 23 percent of total income.

- The corporate tax rate is set to decline from 28 to 20 percent.

- A number of taxes are increasing or being introduced to fund income and corporate tax cuts. Changes include: increases in the departure tax (from FJ$100 to FJ$150), and in duties on alcohol and tobacco products; expansion of the hotel turnover tax; and introduction of stamp duty, a 1 percent telecommunications levy, a 2 percent credit card levy, and charges on third party insurance.

1) Tax Reform

Tax reform is the salient feature of the 2012 Budget.

Changes announced last week need to be considered together with last year’s Budget, which increased various taxes. It is these tax increases in 2011 that are partially funding tax cuts in this year’s Budget. Most noteworthy was the 2011 increase in the Value Added Tax (VAT) rate, which went from 12.5 to 15 per cent (a move which was strongly criticised when announced). The 2011 Budget also introduced a levy on exports of unprocessed fish, a departure tax, and stamp duty taxes. In a measure that led to a standoff with Fiji Water, the government also dramatically increased the Water Resource Rent Tax applicable to large exporters from 0.33 to 15 Fiji cents per litre.

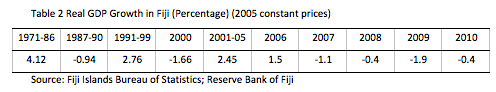

Changes since 2011 that reduce direct (income and corporate) taxes while increasing indirect (VAT) taxes are to be commended on efficiency grounds. The reduction in direct taxes in this year’s Budget should also produce a much needed fiscal stimulus to the Fiji economy, which has been stagnant since the 2006 military coup (see table 2). The emphasis on larger tax cuts for low income earners is positive in this respect, given the higher propensity for low income households to purchase locally made products (leading to higher multiplier effects).

The risk of this fiscal stimulus is that it could increase inflation, which is already high, measuring 9.1 per cent in October 2011. The government has chosen, rightly in my opinion, to focus instead on economic growth, given the state of the global economy and the likely decline of commodity prices in 2012.

From an equity perspective, the impact of the tax reforms is a more complex story. Income tax cuts in the Budget are progressive, given the focus on low and middle income earners. High income earners are now required to pay the “Social Responsibility Levy”, which will see someone on an income of FJ$270,000 paying FJ$111,588 in income tax (or 41 percent of their income). At the same time, the increase in the VAT in 2011 will have a disproportionate impact on low income households.

The group that will suffer in the short-term from tax reforms comprises households that depend on the informal (and untaxed) economy for their income. Much of this group resides in rural areas. Figures from the latest Household Income and Expenditure Survey indicate that 43 percent of rural households in Fiji live below the poverty line, compared to 19 percent of urban households (see Narsay et al. for a detailed discussion, and Morris for an analysis of poverty throughout the Pacific). The tax reforms announced in the 2011 and 2012 budgets are unlikely to directly benefit these low income households, which are for the most part reliant on subsistence agriculture and the informal economy. These households will, however, face higher costs of living as a result of increases in indirect taxes. The hope must be that they benefit from the growth which the tax reforms unleash.

The increase in resource rent taxes, such as those imposed on exports of water and fish, are in my opinion good policy, ensuring that Fiji maximises income from its resources. It will be interesting to see if similar taxes are imposed on mining exports in the future. The Budget points out that mining exports are likely to increase dramatically in the coming decade, with the proposed Namosi copper mine forecast to inject FJ$2 billion into Fiji’s economy (in comparison, tourism in Fiji generates foreign exchange revenue of around FJ$1 billion annually). The increase in the departure tax and hotel turnover tax (which will now apply to many tourism-related activities) should also generate considerable revenue for the Fiji Government (in the order of FJ$140 million, or 7.5 percent of government revenue). The risk, however, is that this will reduce Fiji’s competitiveness as a tourist destination.

2) Public Sector Reform

The elephant in the room for the 2012 Budget is public sector reform. The Fiji Government has been attempting to reform the public sector for decades, with limited success. Personnel costs for the civil service in 2010 comprised 44 percent of total operating expenditure for the government. This compares to between 20 and 25 percent in Samoa, the Solomon Islands and Australia.

The Bainimarama government in its 2009 Budget ambitiously set out to reduce Fiji’s civil service by 30 percent between 2009 and 2011, mainly through redundancies and a lowering of the retirement age from 60 to 55. The measures were supported by a number of Fijian academics at the time. The 2012 Budget however, concedes that only a minor reduction in the size of the civil service was actually achieved.

The process has been incredibly disruptive for the civil service, with what the Budget describes as an “influx” of requests for special appointments. I saw the impact of this measure first hand in a Fiji Government department I was associated with in 2009. In that case, a number of senior (and experienced) middle managers were forced to retire, only to later be reinstated once the impact of their departure on operations became clear. The dismissals and subsequent reinstatements were counter-productive, with adverse impacts on department operations.

This year’s Budget also takes the unusual step of increasing the pay of the civil service by 3 percent (police receive a 9 percent increase, in line with that of the military last year, supporting the notion that armed forces do well under military dictatorships). Although the civil service salary increase runs counter to the government’s reform agenda, it only partially offsets real wage reductions resulting from inflation. The Budget argues for the increase on fiscal stimulus grounds.

The performance of state-owned public enterprises is shown in the Budget to have generally improved in 2010, owing to better (although still poor) economic conditions. However, it is unlikely that this signals a period of high returns from public enterprises, given reforms have been limited to a small number of firms under the Bainimarama government.

3) Fiscal Sustainability

The 2012 Budget makes some progress in addressing the issue of fiscal sustainability.

The 2012 Budget forecasts a deficit of 1.9 percent of GDP in 2012, down from 3.5 percent in 2011. This is within the 2 percent target set by the IMF for Fiji. The improved budget figures are the result of new taxes, tax increases (especially in the VAT), and forecasts of (relatively) strong economic growth in 2012 of 2.3 percent. The impact of corporate tax rate cuts announced in the 2012 Budget will not be fully realised until 2013.

Addressing the issue of fiscal sustainability is long overdue. Since 1992, the Fiji Government has incurred budget deficits in every year with the exception of 1998 and 2008 (the 1998 budget was in surplus only if debt repayments are excluded). The result is that government debt in 2010 was 55.6 percent of GDP. The continuation of budget deficits (with the exception of 2008) by the present government means that government debt is now significantly higher than in 2007, when it was 49.9 percent of GDP.

The high level of public debt in Fiji has a number of implications. First, government must spend significant resources servicing its debt. In 2011, approximately 20 percent of government expenditure will comprise interest payments on this debt. This is almost equivalent to government spending on physical infrastructure such as roads, schools, and hospitals.

Second, government borrowing has implications for the financial sector. Previous budget papers have noted the impact of domestic borrowing on interest rates in Fiji. More important still are the implications for the Fiji National Provident Fund (FNPF), Fiji’s pension scheme. The FNPF is obliged to fund government debt, given that a majority of FNPF Board members are appointed by the Fiji Government. It currently holds around 64 percent of total government debt in the form of government bonds. This has had adverse implications for the financial health of the FNPF, which is now facing the prospect of being unable to fund its liabilities (there are also other reasons for this). The present government has been forced to reduce the pension rate as a result (facilitating this is the proposed Fiji National Provident Fund Decree, which will replace the current FNPF Act and will allow the government to appoint all FNPF Board members.

These implications highlight the importance of controlling government debt levels in future budgets.

In summary, the Fiji Government continues to face substantial economic challenges. The economy has remained stagnant since the military coup. Both inflation and government debt are high. The public sector remains a financial burden.

The 2012 Budget addresses some of these issues. Income and corporate tax cuts should improve efficiency, while also stimulating economic activity. These are funded by increases in the VAT, and the introduction of new taxes on tourism and resource rents, ensuring that the fiscal position of government does not deteriorate. The 2012 Budget therefore strikes a good balance between fiscal responsibility and stimulating economic growth in Fiji. However, it does not address public sector reform issues or adequately resolve problems faced by the FNPF.

Matthew Dornan is a researcher with the Development Policy Centre.

Thanks for the interesting comments.

I agree with most of your points. I share you concerns about implementation, and especially the social responsibility levy which I imagine will encourage tax evasion among high income earners (although note the “tough talk” about cracking down on tax evasion in Bainimarama’s speech, which suggests that govt has at least considered this possibility). I also agree that revenue forecasts in the budget seem optimistic.

Regarding fiscal sustainability, I guess my argument is that the government is stuck between a rock and a hard place, with a stagnant economy and high levels of debt. I think in that context it has struck the right balance between trying to encourage economic activity (especially through giving the money to households that are more likely to spend it in Fiji) while not significantly worsening debt levels. The budget certainly isn’t perfect – just note the increased allocations to the military. It doesn’t address the microeconomic problems in the Fiji economy. But I do think it improves on previous budgets the regime has implemented.

Thanks for a really interesting post. Great to have some commentary on this stuff. I would, though, have a slightly different analysis of the Fiji budget.

Firstly, I’m not sure that there are many efficiency benefits from the tax hhere. The income and corporate tax reductions are to be partially financed through the new Social Responsibility Levy: an additional tax of 23 percent – 29 percent of total income for those earning more than $270,000. This is estimated to provide additional revenues of $9.8 million. The introduction of this levy seems likely to introduce very high marginal tax rates for high income earners, potentially offsetting many of the possible efficiency benefits of the lower income rates, and certainly creating strong incentives for evasion. Tariff and excise measures and new taxes on credit card and telecommunication transactions seem opportunistic, distortionary, and possibly difficult to enforce. The various changes to tariffs and excise also seem to lack a consistent policy intent. Overall, this looks a bit like populist redistributional rejigging, rather than sensible economics.

I also think there are some big questions about fiscal sustainability, and I would say that this budget is heading in the wrong direction – It is not clear how substantial corporate and income tax reductions have been reconciled with a projected 0.5 percent increase in direct tax revenues as a proportion of GDP. The projected increase in VAT revenues of 2 percent of GDP is presumably driven by increased incomes in households with a higher propensity to consume – but this seems fairly optimistic. Some boost to revenue is expected from improved compliance. However, even the Budget Supplement notes an “optimistic outturn”, and my cynical take is that these fiscal outturn projections are politically influenced and not likely to be realized. If Fiji wants to engage in deliberate deficit-financed expansion to get over a bad patch, I think they should be transparent about it and have a credible plan for dealing with the underlying structural issues. I’m worried, though, that this budget is about the spending without the transparency or the plan.

I think you are absolutely right to point out that civil service reform is the elephant in the room – but I guess my take would be towards seeing this budget as populist politics, aimed at retaining the support of the middle-class and public service, rather than sensible economic reform.