The much-anticipated bid for Westpac Pacific (PNG and Fiji) operations by Kina Securities (the owner of Kina Bank) was finally confirmed last month. The offer did not come as a surprise as Westpac moved its Pacific assets into a specialist business division in May 2020, and Kina Securities undertook a capital raising in October. The proposed deal is still pending regulatory and shareholders’ approval.

Currently, only four commercial banks – Bank of South Pacific (BSP), Kina Bank, Westpac and ANZ – operate in PNG with ANZ focused solely on institutional banking. BSP owns more than 50% of the total assets of the commercial sector and has a market share of 63% of loans. If the acquisition goes through, Kina Securities will have nearly all the remaining market share.

Unlike its acquisition of ANZ retail, commercial and SME operations in 2019, Kina Securities says that it intends to maintain Westpac’s commercial banking licence and run the branch network separately. It claims therefore that there will be no lessening of competition. However, this is unconvincing. Despite being run separately, there will be ample opportunity for the two banks, which serve the same shareholders, to collude for strategic purposes. In addition, there is no guarantee that any separation will be permanent.

A further weakening of banking competition in PNG would be a bad thing for several reasons.

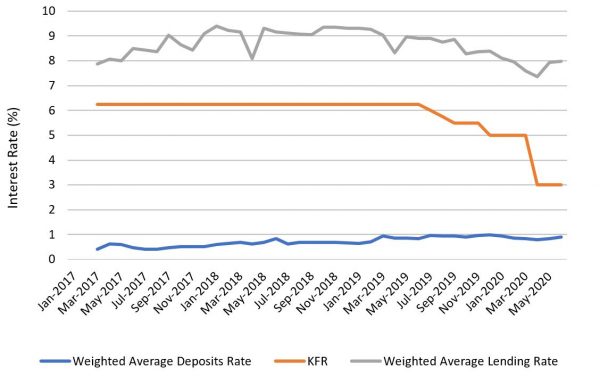

As shown in Figure 1, there is already a massive spread in PNG between the very high rates at which funds are lent out by the banks and the very low rates depositors receive on their savings – in fact, one of the highest interest rate spreads in East Asia and the Pacific.

Figure 1: Deposit, lending and policy (KFR) rates (%)

As Figure 1 also shows, banks are already not incentivised to transmit interest rate adjustments by the central bank (the KFR policy rate) to their consumers as there is little need to compete for loans and deposit base. If banking competition reduces further, banks will possess even more market power to set their own lending and deposit rates, and monetary transmission will be further weakened.

The two remaining bank owners may engage in anti-competitive behaviour by manipulating interbank and other market interest rates to maximise returns. For instance, they may collude to set a common interest rate floor for their lending products and promise not to undercut each other to avoid direct competition. The same applies to deposit rates.

In other countries, banks with high market concentration have been found to fix prices and rig bids in the foreign exchange interbank market to boost profits. PNG is unlikely to be an exemption.

In addition, PNG banks are already some of the unfriendliest in the region. Consumers are often required to pay for basic banking services such as account opening, ATM balance enquiries and cash withdrawals but receive poor service delivery. As banking competition decreases there will be less economic incentive to improve service delivery, and rip-offs like these could get even worse.

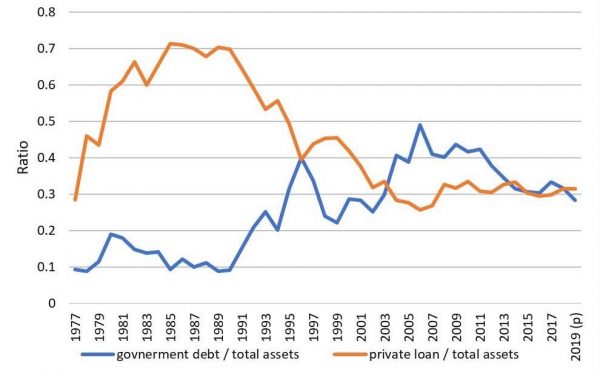

Further reducing banking competition will also lead to heightened risk aversion, and less lending to the private sector. There are already signs that PNG banks prefer lending to governments rather than firms (Figure 2). Having private investment crowded out by public investment is detrimental to economic growth and development, and will make it harder for smaller firms especially to access credit.

Figure 2: Bank’s holdings of PNG government debt vs private lending

Financial inclusion is also at risk. Lesser banking competition has been found to reduce the supply of financial products, increase the rates and fees paid, curtail financial innovation and decrease the quality and variety of products offered. That said, Kina Bank made a commitment to expand its financial inclusion effort in PNG in 2019 via its investment in MiBank, a microfinance institution. The Asian Development Bank (ADB) is also currently the second largest shareholder of Kina Securities, following its $10 million investment in the company in 2019. They may use what shareholder power they have to encourage decisions that align with their own inclusion goals. Though these are positive signs, greater profitability and expanded financial inclusion do not always go hand in hand, and economic theory would suggest that healthy competition is more likely to create sustainably lower prices and better access than does relying on the benevolence of banks.

PNG’s financial regulator should take its fair share of the blame for not making the PNG banking sector more entry friendly. A recent study by ADB shows that regulatory barriers and high costs have discouraged the growth of the banking sector. The study pointed out that the increasing compliance with regulations related to consumer registration has led to increasing documentary requirements and high compliance costs. While strong oversight is necessary to guarantee financial stability, financial regulators must tread carefully to avoid their actions leading to financial exclusion.

Of course, if Westpac wants to exit the Pacific, it needs to find a seller. But PNG needs new entrants into its banking sector. The central bank should consider encouraging new entrants from the existing non-bank financial institutions.

A competitive financial system is vital for high and sustained growth. The people of PNG will find themselves worse off if one day they wake up to just two companies serving their retail banking needs.

Thank you Dek for your excellent assessment. I agree that a duopoly in the banking sector is bad for PNG customers and the financial industry. In my view;

• Competition in the banking sector in PNG is highly concentrated at the moment with a Herfindahl-Hirschman Index (HHI) of 4, 290 in loans – HHI is a commonly accepted measure of market concentration and HHI above 2,500 is considered a ‘highly concentrated’ market. The acquisition will add 158 points, bringing it to around 4,448 points. Basic rule of thumb shows that, mergers that add 200 points raises antitrust concerns, which is not the case here. In my view, it is highly concentrated now, mainly because of BSP’s significant market share of 64% in loans and deposit.

• Kina bank plays a more active role in the GoPNG’s financial inclusion initiatives, as evidenced by its partnership with MiBank and its acquisition of ANZ’s retail, SME and commercial business. It is more focused on reaching the unbanked population than any of its peers in PNG market.

I would propose two alternative approaches that can be looked at jointly by ICCC and Bank of PNG in light of the Kina’s proposed transaction;

• Encourage entry of new international banks into the market subject to compliance and regulatory checks. In addition, it should examine the ‘excessive regulation and high costs’ highlighted by ADB in its 2015 report. This would make pathways for new entrants and also support growth of local financial companies.

• The Bank of PNG and ICCC know about the single borrower and large exposure limits in commercial banks, especially BSP given its market share – Prudential Standard 1/2011. It should direct BSP to reduce entity exposures in a prudent manner or restructure some of its loan exposure especially to the Government or SOEs. Similarly, BSP should restrict refinancing of new loan request from borrowers that have it has high exposure – prerogative of BSP. This would in my view reduce BSP’s high market share, thereby reducing market concentration in the banking sector.

I believe these approaches are in the best interest of the banking sector and consumers ultimately.