Remittance costs in the Pacific are widely believed to be high. This blog shows how this common perception is a product of how such costs are measured. A different but reasonable approach paints a very different picture.

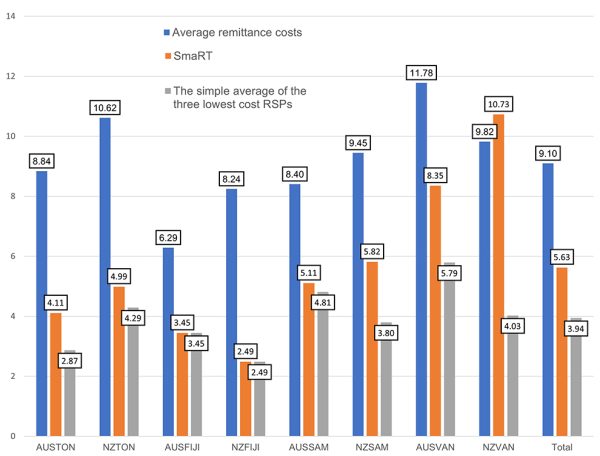

The World Bank’s Remittance Prices Worldwide (RPW) website is often used to calculate average remittance costs globally and in specific corridors (sending and receiving country pairs). Average remittance costs are usually a simple average of the costs of using Remittance Service Providers (RSPs) listed in RPW. Figure 1 shows that the average remittance cost in the Pacific was 9.1% in the fourth quarter of 2022 (the “Pacific average” includes Fiji, Tonga, Vanuatu, and Samoa, as noted in a previous blog), higher than the global average of 6.25% and more than triple the global target of 3%.

Figure 1: Remittance costs in four Pacific island countries, March 2023

Source: Remittance Prices Worldwide.

However, this may not give the best picture of remittance costs in the Pacific. In 2016, RPW introduced the Smart Remitter Target (SmaRT) as an alternative measurement of remittance costs accounting for changes in remittance markets and RSP accessibility. SmaRT is a simple average of the three cheapest RSPs in a given corridor after dropping RSPs that do not satisfy certain criteria on transfer speed, access points, and availability of technologies. The average SmaRT of the four countries above is 5.63% in the same quarter (Figure 1). The simple average of the three cheapest RSPs is 3.94%, just 0.94 percentage points higher than the global target.

It is important also to consider potential fluctuations, which require higher frequency data. Send Money Pacific (SMP) and Saver Pacific (SP) are platforms that compare remittance costs and speed of transfer across different RSPs. A recent report on remittance data collection in the Pacific (funded by the Pacer Plus Implementation Unit and the Asian Development Bank, and done by Saver.Global, which runs Saver Pacific) highlights how this type of data is needed to understand fluctuations in remittance costs within RSPs over time. However, such data collection takes time and is limited to formal channels — and these two platforms only provide users with comparisons at a single point in time, not actually over time.

There are three main differences and one similarity between SMP and SP.

First, data coverage. Only SMP provides total remittance costs in percentage terms to the public. We derived it ourselves for SP data.

Second, the timing of data updates. SMP updates every Thursday, while SP updates irregularly, with some RSPs (for example, ANZ, KlickEx, and OFX) updated daily, in real time. This leads to a slight difference in costs reported for the same RSPs between the two platforms.

Third, the number of RSPs. On 3 August 2023, SMP presented 35 options from 14 RSPs (with different transfer methods) in the Australia-Tonga corridor and SP presented 21 options from 15 RSPs.

Importantly, both platforms show similar fluctuations in remittance costs over time although the cheapest RSPs can be different on some days by a tiny margin.

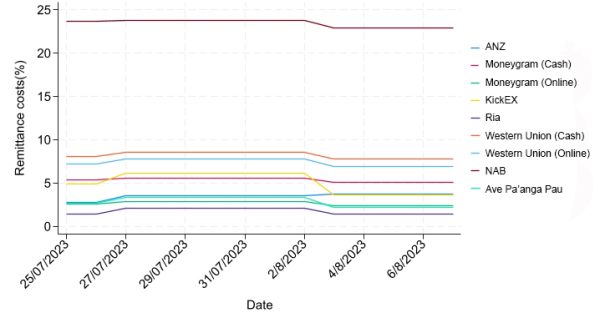

We manually collected the remittance cost data for each of the five lowest-cost RSPs, the highest-cost RSP, Moneygram, and Western Union, when sending 200 dollars (AUD and NZD) from Australia and New Zealand to Tonga each day from 25 July to 7 August 2023 (this final data collection followed weeks of pilot data collection before it). We recorded remittances reported to be received in local currency, fixed fees, exchange rates, total remittance costs in percentages, transfer methods, and transaction speeds.

Figure 2 shows the short-run fluctuations in remittance costs for the seven RSPs in the Australia-Tonga corridor using SMP data (see our full paper for results using SP and for the New Zealand-Tonga corridor). Low-cost options are clearly available, and there are large differences between low- and high-cost RSPs.

Figure 2: Remittance costs in the Australia-Tonga corridor (%)

Source: Maeda, Edwards, and Suryadarma (2024).

In the Australia-Tonga corridor, Ria charges 1.7% on average, which is lower than OFX and NAB by more than 15 percentage points. In the New Zealand-Tonga corridor, the average cost of Ave Pa’anga Pau is just over 3%, but Kiwi Bank and ASB charge more than 15%. Importantly, the rank ordering is generally stable over time: what is the cheapest today is likely to be the cheapest tomorrow, and so forth.

Table 1 shows that the average of the five lowest-cost RSPs was 3.1% and 4.8% in the Australia- and New Zealand-Tonga corridors, respectively, more than five percentage points lower than a simple average from RPW.

So, average remittance costs look quite different depending on what you take the average of, an analytical decision that can matter a lot for substantive conclusions. The long-standing perception of high remittance costs in the Pacific appears to be based on simple averages of remittance costs across all RSPs, regardless of market share and accessibility. Yet, if households and workers were to choose low-cost RSPs, average realized costs would be lower than 5%, perhaps close to the global target of 3% (Table 2).

Unfortunately, in the case of Tonga, people tend to choose services that lead to higher realised remittance costs, as we will show in a companion blog.

This is the first in a three-part series.