In their recent blog, Richard Curtain and Stephen Howes showed that as the Pacific Australia Labour Mobility (PALM) scheme continues to grow, new countries are emerging as the dominant suppliers of labour to Australian employers. In 2023-24, Fiji has overtaken Vanuatu as the biggest supplier of PALM workers, with Solomon Islands moving into third place, ahead of Tonga and Timor-Leste.

Market share is also changing. The top three countries that have historically provided the most PALM workers – Vanuatu, Tonga and Timor-Leste – have seen an overall decline in market concentration down from 78% in June 2019 to 54% in May 2024, as total PALM numbers have risen.

Total PALM numbers tell an important story about the rapid rise of some PALM countries, and the slower growth experienced by others. However, the picture is more nuanced when PALM data is broken down by stream – the short-term, seasonal stream mainly for horticultural work which was formerly the Seasonal Worker Program (ST PALM), and the long-term PALM stream which grants visas for up to four years (mainly for abattoir work).

Data released by the Department of Employment and Workplace Relations (DEWR) on the number of PALM workers in Australia in June 2024 show that Vanuatu remains the top-ranked provider of seasonal workers, with ni-Vanuatu workers accounting for 33% (5,250) of all ST PALM workers. Timor-Leste (18%) and Tonga (17%) remain the other two main source countries.

Fijians accounted for 10% (1,615) of ST PALM workers in Australia in June, with another 8% (1,240) from Solomon Islands. Where Fiji and Solomon Islands are experiencing rapid growth is under the long-term PALM stream.

In New Zealand’s case, Vanuatu, Samoa and Tonga have been the main sources of seasonal labour under the Recognised Seasonal Employer (RSE) scheme since its introduction in 2007. These three countries remain the top three RSE labour supply countries, both in terms of absolute numbers of seasonal worker arrivals and in terms of their combined percentage share of the RSE workforce. As in Australia, their combined market share has dropped slightly as annual RSE numbers have grown. In 2023-24, their combined share accounted for 71% of total RSE arrivals (17,599), down from 76% of total arrivals (12,581) in 2018-19.

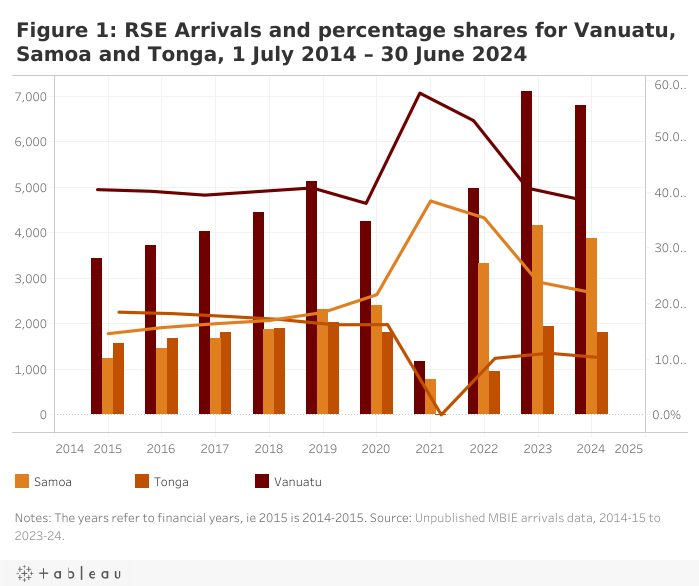

While Vanuatu, Samoa and Tonga retain the top three places, RSE employers’ demand for labour from these three countries has varied somewhat over the past decade (Figure 1). Vanuatu has always provided the highest number of workers in any given year. Tonga used to be the second-largest RSE labour supply country but was surpassed by Samoa in 2018-19. By 2023-24, Tonga’s share of RSE worker arrivals (10.3%) was just over half what it had been ten years earlier (18.4%).

Actual numbers recruited from Tonga remain relatively steady, at around 1,800 per year, but as total RSE numbers have grown in line with increases to the RSE annual cap (now set at 20,750 for 2024-25), Tonga’s share has fallen. For Samoa, RSE numbers rose 80% from 2,315 in 2018-19 (pre-COVID) to 4,160 in 2022-23, before dropping in the last year to around 3,800.

Solomon Islands, Papua New Guinea and Fiji were all late entrants to the RSE scheme, formalising their engagement in 2010, 2013 and 2016 respectively. Over time, their RSE numbers have grown, especially post-COVID when RSE employers have been encouraged to diversify their recruitment away from the top three source countries.

In 2023-24, Solomon Islands (1,207) and Fiji (1,094) both supplied over 1,000 RSE workers for the first time, increasing their shares of total RSE arrivals to 6.9% and 6.2% respectively. Given the current trajectories of growth in RSE arrivals from both Solomon Islands and Fiji (Figure 2), one or both of these countries may well displace Tonga as the third-ranked provider of RSE labour within the next two to three years.

PNG is also experiencing significant growth in RSE numbers. In 2023-24, RSE employers recruited 640 workers from PNG — an increase of 158% (248) on the previous year. PNG’s market share has more than doubled from 1.4% of total RSE arrivals in 2022-23 to 3.6% in 2023-24.

Vanuatu, Samoa and Tonga remain favoured sources of RSE recruits – 91% (163) of the 179 active RSEs who recruited in 2023-24 sought labour from one or more of those three source countries.

Where there has been a change in recruitment practices, however, is in the share of RSEs that recruit all their labour from just one country. In 2014-15, 72% (73) of the 112 RSEs recruited all of their labour from either Vanuatu or Samoa or Tonga. By 2023-24, this share had fallen to 54% (88) of the 179 active RSEs.

In other words, at the level of individual RSE enterprises, a shift is occurring towards more multi-country RSE workforces (as opposed to only recruiting from one or two RSE source countries). This can be seen in Figure 3 which shows the number of employers recruiting RSE workers from one source country, two to three sources and four or more source countries since 2014-15. Over the decade, the number recruiting from one source country has dropped from 71% to 57%. Almost one third (32%) now recruit from two or three sources, up from 21% a decade earlier, and those recruiting from four or more countries has risen from 7% to 11% over the same period.

For countries like Fiji, Solomon Islands and PNG – all of which are seeking to grow their RSE participation rates – this is good news. In 2023-24, 62 RSEs recruited labour from these three countries, almost double the number of enterprises (37) that recruited from them in 2018-19, before the pandemic. As the RSE scheme continues to grow, more (potential) job opportunities for citizens of these countries are created.

Diversification of labour sources by RSE employers is a positive move. For RSE enterprises it helps mitigate the risk of being too reliant on one country as a source of seasonal labour, which can be problematic when natural disasters strike, or other external factors negatively impact on recruitment plans. It also means employment opportunities are being spread more widely across Pacific sending countries.

While diversification in labour sources is occurring, RSE employers’ reliance on Vanuatu, especially, as a labour source remains high. In 2023-24, 59% (105) of the 179 active RSEs recruited from Vanuatu, with ni-Vanuatu workers comprising close to 40% (6,803) of total RSE arrivals (17,599). This tends to suggest continued dependence on one labour supply country that, for many RSE employers, was the first country they recruited from. Ongoing problems with air services between Vanuatu and New Zealand may, however, mean more employers explore alternative labour sources in future.

Excellent material