Most Pacific island countries got off relatively lightly with last week’s Trump “reciprocal” tariff announcement. Ten were given tariffs of 10%, the minimum handed out. (Timor-Leste also got a 10% tariff.) Three Pacific nations were given higher rates: Vanuatu (23%), Nauru (30%) and Fiji (32%).

Two Pacific countries were left out of the tariff list altogether: Niue and Palau. That’s good news for them — no new tariffs on their exports to the US — but indicative of the slapdash nature of last week’s US tariff announcement.

There is no reason for Federated States of Micronesia and Marshall Islands to get a 10% tariff, and Palau to escape it (all three are Compact States, which have a special relationship with the United States). And no reason for Cook Islands to get a 10% tariff, and not Niue — both have the same special relationship with New Zealand. (Even Tokelau had a tariff slapped on it, though it is a dependent territory.)

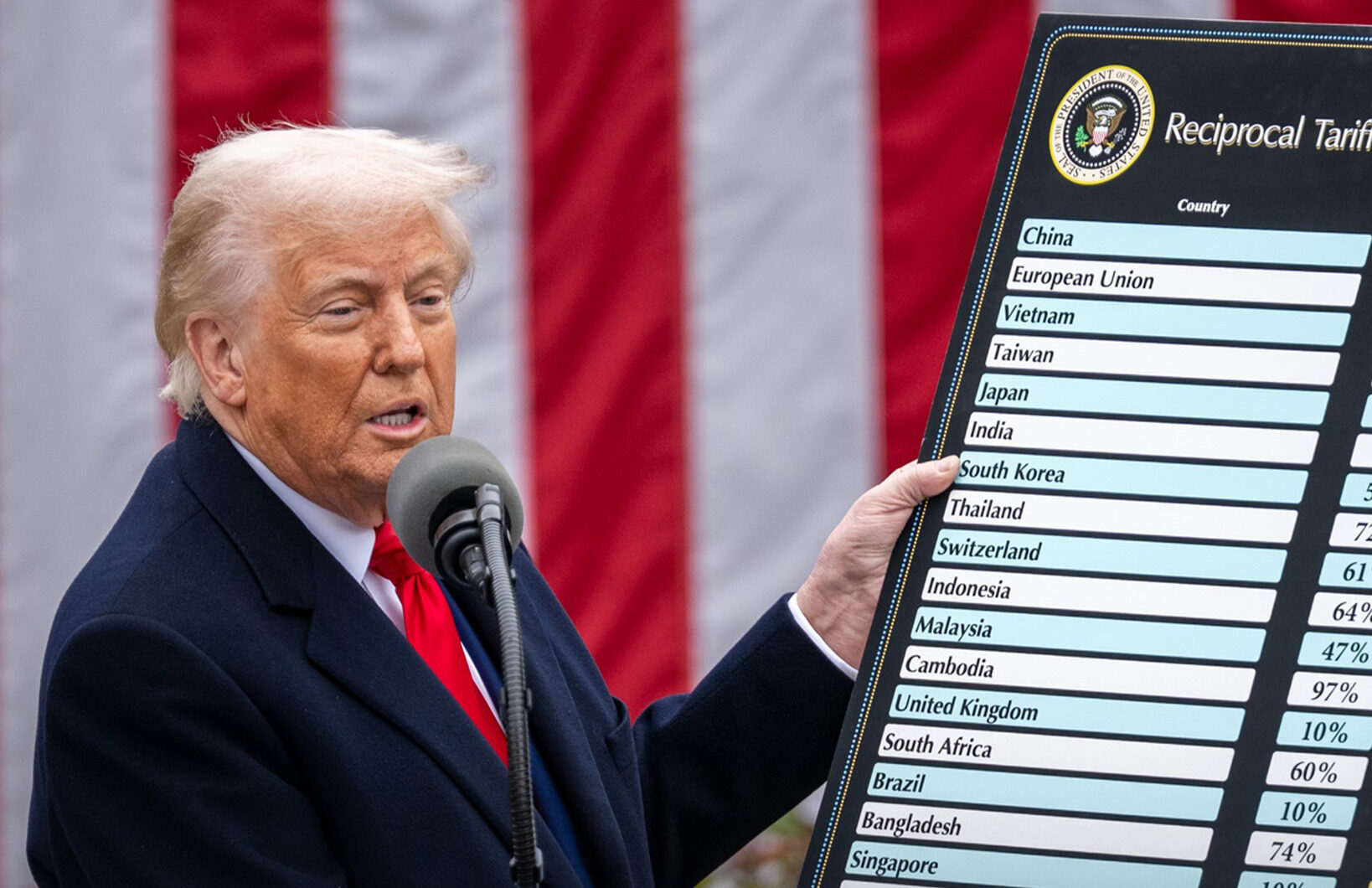

As is by now well known, Trump’s new tariffs are not in fact reciprocal, but are instead linked to the trade deficit or surplus each country is running with the US. Countries with a large trade surplus with the US (that is, they export a lot more to the US than they import) are the ones who got high tariffs. Everyone else got 10% (or was meant to).

The Pacific is not a large goods trading region, and most countries neither export nor import much from the US. The Pacific is much bigger exporter of services, such as tourism, but services were excluded from the Trump tariff calculations. Since Pacific nations are not in general running large goods trade surpluses with the US, most received only the minimum tariff. But there are some exceptions. Fiji is one.

In 2023, according to the OEC database, Fiji exported USD366 million worth of goods to the US. That’s about 8% of its GDP. 66% of this amount derived from exports of Fiji Water and another 14% from tuna exports. But the value of US exports to Fiji was only USD158 million. So, a large trade deficit and therefore a large Trump tariff (32%).

Unlike Fiji, Vanuatu and Nauru don’t consistently run trade surpluses with the US. They had the bad luck to do so in 2024 (according to the UN trade database) but in 2023 both countries ran deficits with the US. The fact that both countries have nevertheless had large tariffs imposed on them speaks to the absurdity of the entire US tariff exercise.

According to the OEC database, Vanuatu only exported USD6.5 million to the US in 2023 (only 0.7% of GDP). Around 73% was kava. Nauru is a tiny exporter and importer (with both values typically only about USD1-4 million each).

What will the impact of these tariffs be? Here we need to distinguish between the direct impact on the Pacific of the tariffs imposed on them and the indirect impact on the Pacific of the entire set of Trump tariffs.

The direct impact of the tariffs on the Pacific will be limited, just because the amounts at stake are in general small. Only two of the Pacific countries that were subjected to tariffs have a ratio of exports of goods to the US in excess of 2% of GDP: Fiji (7.7%) and Marshall Islands (8.1%). Marshall Islands has been given only a 10% tariff. Fiji, with its 32% tariff, will definitely be the hardest hit. But Fiji Water is a premium product, and highly profitable, and will likely be able to absorb at least some of the tariff hike. Fish producers from Fiji will suffer. Kava exporters from Fiji and Vanuatu will also suffer. Though there are kava shortages, it will be interesting to see if kava production moves to other Pacific countries with lower tariffs.

The much bigger impact of the Trump tariffs on the Pacific will be the indirect or global impact. The tariffs announced last week constitute a huge shock, bigger than expected. With stock markets crashing, confidence plummeting, and a trade war underway, economists are predicting a US if not a global recession.

This will have some benefits for the Pacific. Lower commodity prices will mean cheaper petrol and diesel, for example. But overwhelmingly the impacts will be negative. Lower, perhaps negative, US and global growth will impose huge costs on a region that is still recovering from the pandemic. It will mean fewer tourists coming to the Pacific, fewer jobs for Pacific migrants and therefore less remittances, and lower tuna prices and therefore lower license fee payments from ships fishing in Pacific waters.

The Pacific will certainly be less directly affected by Trump’s tariffs than Asia. Nevertheless, these tariffs, because they are very bad news for the global economy, are very bad news for the Pacific.

Thanks for this timely blog. Don’t forget the impact on some Pacific Island government budgets through their Trust Funds (FSM, Kiribati, Nauru, Palau, RMI, Timor-Leste and Tuvalu) with earnings negatively impacted by the global fall in the stock markets.