Renascent interest in adaptation to climate change has inevitably resulted in a variety of competing conceptual approaches. Despite the existence of suitable analytical tools, a credible economic perspective has been lacking.

In a report I recently co-authored with Stephen Howes for the World Bank, I set out to fill this gap.

Possibly because of the strong techno-scientific genesis of climate change issues, most analytical effort to date has been misdirected at estimating potential impact costs, or on developing indexes of ‘vulnerability’ and ‘adaptive capacity’. Apart from the empirical difficulty of estimating costs at the local level, it is generally not possible to distinguish between costs that are attributable purely to climate change and those that involve development. Moreover, the costs of damage alone cannot provide a basis for formulating policy, because they are unlikely to accurately reflect benefits in terms of willingness to pay to avoid the damage. Indexes of vulnerability are conceptually flawed because of their arbitrary and atheoretical nature, including the use of scores and weights to aggregate incommensurable variables. But the key flaw in the ‘damage costs’ and index approaches is that they provide no policy insights into how much action should be taken, or when it should be taken.

The hallmark of climate change is uncertainty. The stochastic nature of a myriad of key variables means that it is not possible to say with any certainty – or even to estimate probabilities with any significant confidence – when changes will occur, how strong the impacts will be, how they will differ at the local level, how frequently extreme events will occur, and how successful mitigation will be.

Efforts to specify deterministic policies and projects for adaptation in response to unknown levels and timing of climate change are doomed to result in either over or under adaptation. Planning under conditions of uncertainty is thus likely to be wasteful of resources. Building a two metre sea wall around the entire coast of Australia today, for example, would be wasteful of social resources, as would failure to take any action at all over the next 100 years.

Rather than focusing on deterministic solutions based on unknowable probabilities, it is better to proceed from the basis that climate change involves very significant levels of uncertainty. Fortunately, economists already have well-developed tools for analysing situations of uncertainty. For example, financial markets involve significant uncertainty about future price movements of traded assets like bonds and equities (shares). Investors in such markets are able to reduce their risks by using options as a hedge. A financial option provides a right, but no obligation, to buy or sell a share if its price moves above or below a contracted level within a set period. If the price of the share moves in the direction expected by the investor, its purchase and sale will generate a profit. If it moves in the opposite direction, only the cost of the option is lost, rather than the value of the share itself.

Options also exist in the world of physical (‘real’) assets. They are useful for assisting decision-makers to incorporate uncertainty within a cost-benefit framework as well as incorporating flexibility into the design of adaptation policies and projects. For example, airport runways may need to be lengthened in future to provide sufficient lift during take-off. But building longer runways immediately is likely to be premature and costly. A ‘real option’ would be to merely buy additional land that will permit future expansion (it may also be cheaper to buy an option to buy the land). If not required in the future, the land can be sold, or put to other uses. However, the flexibility or potential to make use of the land, if required in the uncertain future, is valuable. The use of options in the face of uncertainty is also intuitively sensible.

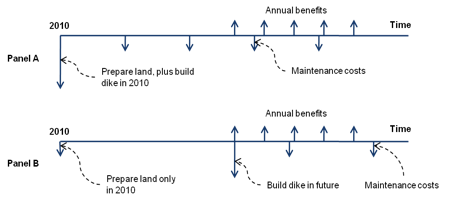

An investment diagram can be used to illustrate the ‘real options’ approach in terms of the construction of a sea wall or dike. In panel A, the dike is built immediately, while in panel B only the land is prepared, as an option, and the dike itself is built once it is clearly required due to the extent of actual climate change. Clearly, in this simplified example, the net present value of the benefits will be higher where an option has been generated.

Generating or creating options on projects and policies requires a good deal of creativity by both the public and private sectors. However, the effort involved will be repaid by savings, both financial and in terms of social resources.

Leo Dobes is Adjunct Associate Professor at the Crawford School of the ANU, and co-author of the recent World Bank APEC report on Climate Change and Fiscal Policy.

To find out more, see Ch. 5 of the World Bank report, and the references therein.