The 2022 federal election brought Australia’s role in the Pacific into focus, and a clear emphasis from the new foreign minister, Senator Penny Wong. In her first message to the Pacific, the Foreign Minister touched on the importance of remittances, a critical element of the relationship between Australia and our Pacific partners.

According to SaverPacific data, sending money from Australia and New Zealand to the Pacific region incurs some of the highest remittance costs in the world.

Remittances form a major part of island economies, and reducing their cost has been a focus of Australian governments of both political stripes for over a decade, but practical action on the key issues keeping costs high has been lagging.

Remittance costs to the Pacific have declined over the past decade as new digital services have launched across the region. Despite these gains, the costs remain worryingly and persistently high. At close to 10.1%, sending money from Australia to the Pacific (specifically, Fiji, Samoa, Tonga, Tuvalu and Vanuatu) is significantly higher than the global average of sending remittances (6.04%), and triple the target amount of the UN Sustainable Development Goals.

Good work has already been done to reduce the cost of remittances to this region. Both ANZ and Commonwealth banks appear to have eliminated their fixed fee for bank-to-bank transfers into the Pacific.

These initiatives are commendable but don’t solve the problem. Only 40% of Pacific Islanders have access to formal banking services, so eliminating the fee for bank-to-bank transfers isn’t a universal solution. These banks are also still charging a mark-up in their retail exchange rate – an insidious hidden fee which they can use to gouge their customers.

The promise of specialist remittance companies and other fintechs is that they offer more agile, customer-focused solutions to traditional banking problems. While companies such as Wise might not always be the cheapest solution, their transparent pricing model shows the true costs of sending money abroad, encouraging consumers to find the best possible deal.

More transparency in foreign currency pricing

The easiest and quickest thing to do to reduce costly Pacific remittances is empower consumers. Give them the tools to shop around for the best deal. This means that the Australian Competition and Consumer Commission needs to review their best practice guidance for foreign currency exchange to improve price transparency.

As both Australian MP Andrew Leigh and the UK’s Behavioural Insights Team have argued, providers of international currency exchange should indicate both the up-front fee and any hidden markup in the retail exchange rate they offer their customers.

Equally important from the perspective of allowing consumers to find the best deal is expansion of the open banking regime in Australia – the Consumer Data Right (CDR). This would involve expanding the product reference data to include foreign currency exchange. This product data can then be used by authorised data holders to build meaningful and up-to-the-minute comparison tables showing the cheapest way to send money from one country to another.

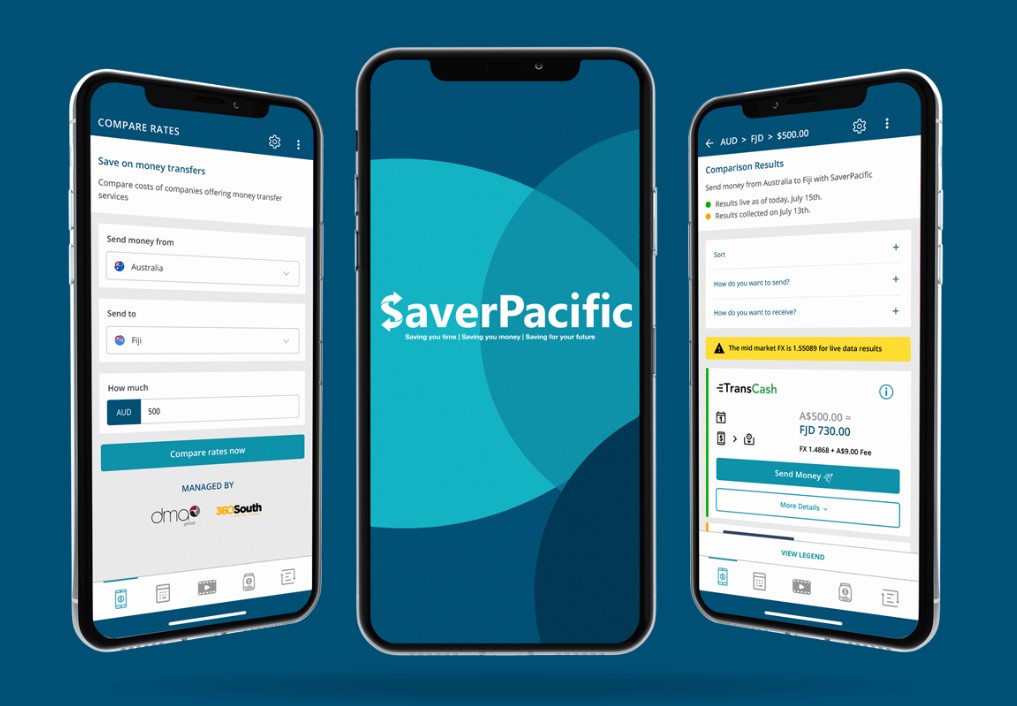

One example of how open banking could improve consumer outcomes is through the remittances and financial literacy platform SaverPacific, which provides a comprehensive comparison of remittance services across ten Pacific remittance corridors.

The website contains some real-time data from money transfer operators, but an expansion of the CDR’s product reference data to include bank foreign exchange rates through an open API (application programming interface) would mean that all providers of cross-border currency exchange are required to provide up-to-date data for authorised data holders. This would reduce the manual inputs needed into the website and make the data more up to date.

Improve the financial architecture

The Reserve Banks of Australia and New Zealand are engaged in developing a regional electronic KYC (‘know your customer’) facility, which is intended to cover the entirety of the Pacific. Allowing digital verification would be game changing, as it would allow many more customers to access banking services in countries where access to personal documents might be limited or non-existent.

This project was announced at the end of 2019, with the tendering process commencing in September 2021 with a request for information. It is good that this is proceeding, but given the impact that the lack of certainty on this issue has had on money transfer operators, it cannot come soon enough.

A comprehensive, collaborative, risk-based approach to KYC regulations and compliance is needed in order to better facilitate access to financial services, as required by the Financial Action Task Force’s standards. A tiered risk-based KYC system can operate – as it does in African and Central American markets – with lower levels of KYC required for lower value mobile money accounts and transfers, and higher levels of KYC for higher risk sectors and for traditional bank accounts, providing a full range of functionalities.

Common regional standards of KYC need to be developed to support remittances and cross-border money flows. Given the complete absence of any identity documents in certain parts of the Pacific, letters of reference from employers or local government officials should be considered as a lowest common denominator KYC ID verification requirement. While this isn’t a perfect solution, it beats the alternative: that the unbanked move towards informal remittance channels which are not regulated or monitored.

The Australian government – given it is assisting Telstra to purchase telecommunications provider Digicel – should be leveraging this investment to facilitate the rollout of more feature phones with brand-agnostic mobile wallets, as well as take advantage of cheaper and more available smartphones. Feature phones, which have some internet capability but are less functional than a smartphone, can provide a form of wireless account and allow mobile banking, spending and the receipt of money from overseas.

Tackle debanking

Governments should seek to resolve the issue of debanking, an uncompetitive practice where established banks cease working with innovative start-ups, often for spurious reasons. This matter has already been referred to the Council of Financial Regulators, but any policy response should ensure that Australian bank risk assessments comply with global standards, i.e. that the actual risk is assessed based on evidence and not merely assumed, and that supervisors assess the quality of institutional risk assessments, especially where they inform debanking decisions.

Wise has sought correspondent banking relationships in the Pacific, unfortunately without any success. When correspondence was entered into with a particular bank with a presence in the South Pacific, Wise was told explicitly that the bank was “not currently looking at partnering in a low cost service model”. In further correspondence, where it was asked whether it was a question of compliance or commercial considerations, the answer was that it was “both”.

If the Australian government improves remittance price transparency and comparison, facilitates eKYC, and eliminates improper debanking, this would go a long way to reducing the costs of sending remittances.