Policymakers in Pacific island countries (PICs) are eager to leverage the opportunities of the digital money revolution by developing payment systems, expanding financial inclusion, and mitigating the loss of correspondent banking relationships.

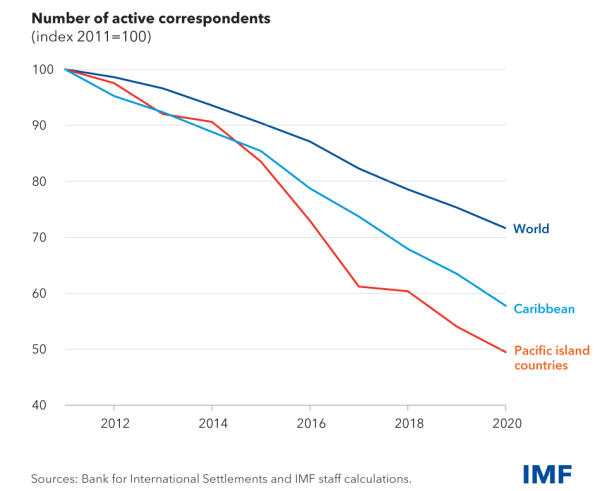

These countries, some of the world’s most remote and dispersed, face challenges in connection with financial services and inclusion, partly due to their small size and unique landscape. Limited and unequal access to financial services contributes to persistent poverty and inequality. The countries also are highly dependent on remittance flows, which makes them disproportionately affected by diminishing correspondent banking relationships.

Figure 1: Fraying ties – correspondent banking relationships have decreased more rapidly in PICs

The monetary landscape in the region is diverse. Six of the 12 PICs do not have a national currency, and instead use other countries’ currencies for payments. Three countries covered under the Compact Agreement with the United States — Marshall Islands, Micronesia, and Palau — use the US dollar, while Kiribati and Nauru use the Australian dollar. Tuvalu uses the Australian dollar for payments on a de facto basis and has never printed banknotes denominated in its national currency. With no central bank, these six countries do not have a publicly owned and operated national payment system and rely instead on either domestic commercial banks for transactions related to government bonds or subsidies, or on external financial market infrastructures (for example, provided by Australia and the United States).

The region also has large disparities in financial inclusion. PICs’ remoteness, isolation, and population dispersion make the delivery of financial services expensive. While Fiji is at the forefront of financial inclusion, many PICs are struggling to provide access to even basic financial services. Access to finance based on indicators such as access to an automated teller machine (ATM) or the formal banking sector remains generally low in the region. The numbers of commercial banks and branches are limited. Most PICs rely on cash for retail payments, and the number of domestically issued debit cards eclipsed that of credit cards in most PICs. A few foreign non-bank payment service providers (PSPs) are operating in the region, while a small group of PICs have national payment systems to facilitate electronic fund transfers. Overall, the adoption of technology-supported financial inclusion remains limited in the region, while some PICs have made significant progress on the use of mobile-based financial products (particularly Samoa, Solomon Islands and Tonga).

Our latest research explores the potential role of digital money in the region, including stablecoins and central bank digital currency (CBDC). We do not include unbacked crypto assets in our discussion as they do not meet the definition of money.

In an increasingly interconnected world, digital money and related innovations offer advantages such as efficiency, accessibility, and security. Payments will become easier, faster, cheaper, and more accessible, and they may cross borders more swiftly. But it also poses financial, technological, regulatory, and legal risks. Digital money that’s well designed and governed can help realize policy objectives such as financial inclusion and greater cross-border connectivity. It can help empower previously underserved people and groups, providing them with access to financial services and government support. Conversely, adopting digital money without adequate preparation and safeguards can disrupt economies and financial markets. Prolonged interruptions can even cause serious financial stability risks in countries that don’t have the proper capacity. Digital money could also introduce new threats from money laundering and terrorism financing.

The implications of digital money for PICs can be particularly wide-ranging and profound. Many PICs are now examining or experimenting with various digital money options and are at the critical stage of exploring how to leverage digital money to develop financial systems and promote financial inclusion. The IMF has provided some initial advice on digital money, as well as cautioning against premature policy responses on crypto assets.

PICs and other similar countries are constrained by scale and resources in introducing digital money. The digital infrastructure and institutional frameworks — legal, regulatory, and supervisory — needed for successful digital money implementation tend to be underdeveloped. In addition, many countries in the region can’t afford high development costs, such as those for training, operations, and technology development.

Embracing digital money requires underlying infrastructure that’s stable, secure, and accessible. Service providers should be encouraged to develop business models that generate sustained revenue and cover costs. Digital money also must be attractive to use, including by tourists, as they provide a large share of national income for many countries in the region. The legal status of digital money should be clear, as should the obligations of service providers, user rights, and the responsibilities of supervisory and other authorities.

Ultimately, digital money decisions should depend on a variety of monetary and financial conditions, such as the existence or not of a national currency and the maturity of domestic payment systems, besides having in place adequate institutional capacity. Countries with a national currency might eventually be able to introduce a CBDC at some point in coming years.

The maturity of the banking and payment-service provider industries might help indicate what type of digital money or design choices work best for PICs. For example, a two-tier CBDC (whereby the central bank issues currency but delegates the operation of the system to private intermediaries) might be best for countries with national currency and mature banks and payment providers. Elsewhere, foreign currency-based stablecoins could be a realistic alternative for countries without their own currencies, though only with robust regulation and supervision.

PICs could explore a regional approach to introducing new forms of digital money and payments while managing the associated risks. That could entail connecting traditional domestic payment systems, interlinking CBDCs once in place, and establishing or joining multilateral digital payment platforms and regional networks. And it could include knowledge sharing with peers, development partners and international organizations like the IMF.

This is an edited version of a post first published on the IMF Blog. It is based on the departmental paper Rise of Digital Money: Implications for Pacific Island Countries and reflects research contributions from Tao Sun, Arvinder Bharath, Stephanie Forte, Kathleen Kao, Yinqiu Lu, Maria Fernanda Chacon Rey, Piyaporn Sodsriwiboon, Chia Yi Tan and Bo Zhao. For more on the Fund’s work in the region, see the recent commentary by Deputy Managing Director Bo Li and Marshall Mills, who leads the Pacific Islands Division and is mission chief for Fiji.

Leave a Comment