Two concerns are commonly expressed now, most notably and recently in the Addis Ababa Action Agenda, the negotiated outcome document of the Third International Conference on Financing for Development.

The first is that Official Development Assistance (ODA) to the Least Developed Countries (LDCs) is declining. The second is that ODA to countries that have recently ‘graduated’ from low- to lower-middle income (LMIC) status—here called ‘transition’ countries[1]—is declining faster than their governments’ access to other resources for public investment is increasing.

Both of these country groupings are important. As it happens, the combined population of the transition countries is about the same as that of the LDC group: just under one billion people.[2] Their combined GDP, however, is around US$1.3 trillion, comparable with Australia’s or Korea’s, whereas that of the LDCs is just US$0.5 trillion, comparable with Belgium’s or Norway’s. That is obviously not to say that the transition countries are well off: their collective GDP per capita is just over US$1,000, barely above the threshold for graduation to MIC status. The population of this group of countries might be termed the ‘second to bottom’ billion.[3]

A fall in aid to either LDCs or transition countries certainly would be cause for concern. However, the concerns that have lately been expressed seem to have no firm basis in present reality. They seem rather to have assumed the character of dogmas. LDCs and transition countries, as I will show in the second and third in this series of four posts, have in fact fared relatively well in the aid allocation stakes during the MDG era.

But first, let’s give the concerns, or dogmas, a fuller hearing.

In articulating the first of the two dogmas the Addis Agenda says, ‘we note with great concern the decline in the share of ODA to least developed countries and commit to reversing this decline’ (para 52).

Earlier in 2015 the ONE Data Report said, ‘total ODA flows to LDCs have been in worrying decline in recent years’ p. 24).

And in April 2015 the OECD’s press release on preliminary estimates of 2014 aid flows said, ‘flows were stable in 2014 after hitting an all-time high in 2013, but aid to the poorest countries continued to fall’.

In articulating the second dogma the Addis Agenda says, ‘we note with concern that access to concessional finance is reduced as countries’ incomes grow, and that countries may not be able to access sufficient affordable financing from other sources to meet their needs’ (p. 71). The ‘zero draft’ of the document had earlier said, more strongly, ‘when countries graduate to middle income status, they often lose access to sufficient finance to meet their needs’ (para 64).

At the end of 2014, a major ODI report on financing the Sustainable Development Goals said, ‘countries “graduating” into LMIC status face sharply reduced concessional assistance but can expect only gradually increasing tax revenues and not enough market-based finance at the right time (p. 33). The report termed this the ‘missing middle’ of development finance.

The 2015 ONE Data Report took up the latter idea, saying, ‘the … problem of the “missing middle” describes a situation in which ODA and other concessional finance to MICs falls faster than the rate at which domestic revenues and other resources (such as private investment) rise’ (p. 31). It spoke of a need to ‘compensate for ODA shortfalls’.

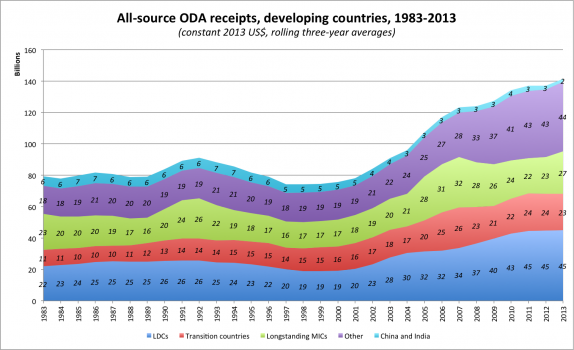

The two dogmas are in fact contraries. Given that total aid has roughly doubled in real terms since the late 1990s, without any major downward kinks in recent times, LDCs and transition countries cannot both have experienced aid loss unless there has been a disproportionate increase in the amount of aid allocated to countries that have long been middle-income-countries (MICs).

There has been no such increase. The collective aid receipts of longstanding middle-income countries (MICs), in both the lower and upper levels of this income category, grew by around 65 per cent from US$16.5 billion to US$27 billion between 2000 and 2013. Over the same period, the receipts of all developing countries doubled, and those of LDCs slightly more than doubled. Since aid to longstanding MICs has been rising more slowly than total aid, aid to LDCs can’t be falling unless aid to transition countries is rising, and vice versa.

However, while the two dogmas can’t both be true, they can both be false. A close examination of the numbers suggests in fact that they are.

By way of creating some initial doubt about these dogmas, the broad pattern of aid allocation over the past three decades is presented in the chart below. The blue layer represents LDCs and the green layer transition countries other than those that remain LDCs. (The special cases of China and India are excluded from the transition country category and represented separately.)[4]

Source: OECD Official Development Assistance statistics. Click to enlarge.

A casual look at this chart rings no alarm bells. Aid to LDCs and transition countries appears not to be falling away in either absolute or relative terms.

In parts 2 and 3 of this series, I will look in some depth at aid flows to LDCs and transition countries, over the past few decades and especially in recent times, in order to demonstrate that LDCs and transition countries have been doing well enough relative to the size of the aid pie since about the turn of the century, regardless of one’s views about the size of the pie. In part 4, I will reflect on what this means and what a target-minded world might want to do about creating incentives for the ongoing provision of adequate amounts of aid to these two groups of countries.

Robin Davies is the Associate Director of the Development Policy Centre.

This post is the first in a four-part series on development finance flows to least developed countries and transition countries. You can access all four posts in the series here.

[1] The alternative term, ‘graduating countries’ is potentially confusing since aid ‘graduates’ are usually countries that have graduated from ODA completely by entering the high-income country category and staying there for several years. The term ‘countries in transition’ previously referred to the countries of the former Soviet Union but has been in retirement for some time.

[2] Including several very recent graduates, there are 27 transition countries, namely Albania, Armenia, Azerbaijan, Bosnia and Herzegovina, Cape Verde, Cameroon, Republic of the Congo, Côte d’Ivoire, Georgia, Ghana, Guyana, Honduras, Indonesia, Kenya, Kyrgyz Republic, Moldova, Mongolia, Nicaragua, Nigeria, Pakistan, Papua New Guinea, Sri Lanka, Tajikistan, Turkmenistan, Ukraine, Uzbekistan and Vietnam. A further 14 countries have graduated to MIC status but remain LDCs.

[3] There are now almost no countries in the low-income country category that are not LDCs. At this point, following the graduation of Kenya and Tajikistan to MIC status, the OECD’s ‘other low-income country’ category contains only the Democratic People’s Republic of Korea and Zimbabwe.

[4] It should be noted here that the ‘other recipients’ category contains mainly aid to unspecified recipient countries participating in regional or global initiatives. DAC donors report a surprisingly large amount of aid in this category—for example, US$46 billion in 2013. It is not possible to determine where this money lands at country level. It is nevertheless considered to be bilateral aid because it does land somewhere.

Great post Robin – it’s so easy for these statements to become accepted wisdom through unquestioning repetition unless someone takes the time to unpack the actual data.

I’d be interested to hear more in a future post about the flow to ‘other recipients’ – which has mirrored the increase to LDCs over the last decade, but certainly outpaced the growth in ODA to transition countries and longstanding MICs – and what the implications of this are. I infer from your comment in footnote 4 that this does not include funding to the Global Fund, Gavi Alliance and the like?

That might have to be a topic for another day given that the present series is already so long as to try perseverance. You are correct that the ‘other recipients’ are unspecified countries only and do not include multilateral organisations and funds. The latter receive about one-third of outflows from DAC donors; developing countries receive the rest plus inflows from multilateral organisations and funds, and from other sources. It’s certainly interesting that there has been such an increase in the amount of aid that is reported as bilateral but not attributed to specific countries. One driver of this might be the increase in the reporting of onshore asylum seeker costs. A chart showing the 30-year trend can be viewed here. The proportion of of ODA in this category has increased from 15% in 1983 to 37% in 2013.

Very good presentation of trends of ODA to LDCs and Transition Countries, Robin. However, it is difficult to generalise the impact of ODA because the performance of each country are different. ODA or any other financial assistance alone can not ensure development. In fact ODA can be a facilitator for development but actual performance and achievements are determined by policies, institutions, legislations and culture of particular country. I personally feel ODA or any international assistance future must be tagged with national policies, institutions, legislations environmental conservation and cultural orientation. Sometime these have been proved as an obstruction in development. I understand, if ODA is tagged with these, the national elite will resist on the pretext of ‘sovereignty’ or manipulate the utilisation of the aid but it shall have to be monitored by a credible international agency so as to ensure both poverty eradication and economic growth in these countries……

Moreover, precaution must be taken that the countries which have ‘graduated’ should not fall back in the earlier position. Thus, there must be two pronged strategy in ODA, i.e. Preventive and Accelerative. The graduated countries must also shoulder some responsibility to help the LDCs. In any case ODA is must for sustainable development, the decline in ODA will be really disappointing….