There has been much enthusiasm about new undersea internet cables in Papua New Guinea (PNG) and predicted improvements in internet pricing, speeds and reliability. This blog post looks at mobile internet prices in the first half of 2020.

The Coral Sea Cable links PNG to Sydney and was completed in December last year. It is now available for use, but there seems to have been limited take-up [paywall]. Pricing is under review, a public consultation process is underway and there are mixed messages about what has happened to date. The Kumul Submarine Cable is a domestic cable throughout PNG and is currently undergoing testing. There are predictions that the two cables “are set to make the country’s internet faster and cheaper” (see also here, here, here, here and here).

We report on data collected systematically using Unstructured Supplementary Service Data (USSD) menus on mobile telephones. Customers use these menus by selecting, for example, ‘1’ to ‘Buy a plan’ then ‘1’ for ‘Data plan’ in the next list of options received and so on. The advantage of using USSD menus to collect data is that this method provides accurate, up-to-date information and can capture temporary promotions. By contrast, collecting newspaper advertisements or pricing information from company websites or other sources may not be as reliable.

This research does not capture the pricing structures of all internet service providers operating in PNG, such as those offering services to businesses, households and universities. Nonetheless, it captures the pricing structures relevant to a substantial portion of the country’s internet users when they access the internet through mobile telephones. Over three-quarters of mobile telephone connections in PNG are prepaid.

Overall, this research has found that there has been no change in mobile internet pricing in the first half of 2020.

Digicel has 92% of the mobile telecommunications market in PNG. Since Monday, 6 January 2020, data has been collected every Monday using the Digicel USSD menu accessed with the code ‘*675#’.

With Digicel’s prepaid plans, there are international voice rates, data plans, roaming rates and a roaming bundle that is available in Australia, New Zealand, Fiji, Nauru, Samoa, Tonga and Vanuatu. Digicel’s data plans allow customers to access the internet via a 3G, 4G or LTE network, depending on what sort of coverage is offered where they are located (note that in some locations, the Digicel network is a 2G service, which is not suitable for using the internet).

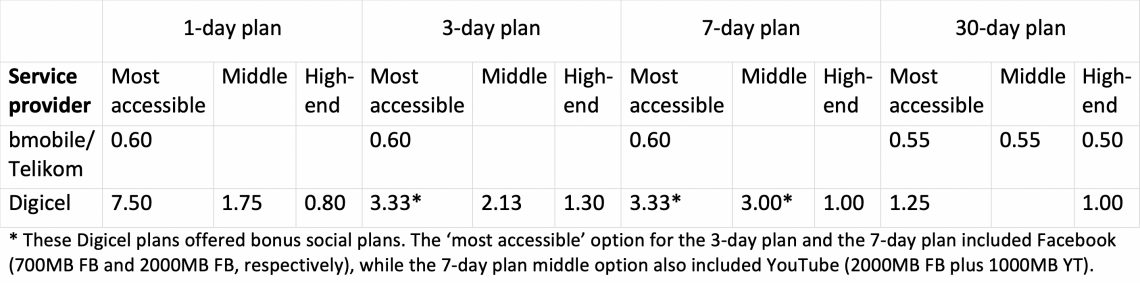

Data plans were captured under the ‘day’ category (1-day, 3-day, 7-day and 30-day) over a period of six months. Among the four categories of day plans, the most accessible, the middle and the high-end data plan option, were recorded. Note that we term the ‘most accessible’ option to be the one that enables a user to access the internet for the least amount of money. For Digicel customers, this is, in fact, the most expensive in terms of kina per megabyte. Users who can afford to outlay a larger amount of money upfront receive a better rate per megabyte.

There were no changes. The Digicel rates were consistent throughout the period of data collection.

Some Digicel plans offered bonus data for use of social media platforms while others did not. For example, the 1-day plan did not include any extras. The 7-day plan has social plans for the most accessible and the middle categories – both include 2 gigabytes of data to use on Facebook, with the middle category providing an additional 1 gigabyte for YouTube. Again, the social plans and pricing structures did not change during the six-month-long data collection period.

Prices for bmobile and Telikom were brought into alignment in 2019 due to a merger, as can be seen in Figure 2 here. (For background on the merger and reasons for it, see this earlier piece.) Since Monday, 6 January 2020, data has similarly been collected every Monday using a USSD menu accessed with the code ‘*777#’ on a bmobile device and also using the same code on a Telikom device. The same prices are being offered through both devices.

Data was collected for the 1-day, 3-day, 7-day and 30-day options. bmobile and Telikom have been offering the same mobile data plans over the period of research, which do not have social bundles included. Again, the cost of data remained the same over the half-year period.

Table 1 presents a comparison of the data rates offered over the six-month data collection period (January to June 2020).

Table 1: Comparison of data rates in PNG (toea per megabyte)

While the Digicel pricing varies by option, it is much more expensive than the pricing offered by bmobile/Telikom: more than ten times as expensive for the most accessible 1-day plan. That being the case, why doesn’t everyone use bmobile/Telikom? We believe that the main reason is that the geographical coverage of the Digicel mobile network is much wider than the coverage of its competitor. Many people in rural areas rely on Digicel as the only available option for their communication needs. Indeed, many of these people make and receive telephone calls but do not use mobile internet regularly or at all. Meanwhile, those residing in urban areas need to use Digicel to stay in contact with their relatives in the village.

In summary, despite the repeated promises and predictions of reductions in internet prices in PNG, there have been no changes in the prices offered in the first half of this year at the retail level. It may be that, as predicted, the new undersea cables will later lead to reductions in prices for consumers. However, several other factors will influence the possibility of this outcome, including the need to recover costs from the new domestic cable, market competition, full operation of the PNG Internet Exchange Point, and existing supplier contracts. The authors will continue to monitor prices and report on trends over time.

Thanks Amanda for this useful piece…yes, an amazing variation in prices. It’s true that one needs two phones, or perhaps three! BMobile to access the internet on a regular and affordable basis; Digicel when you just need to download and it’s taking forever on 3G BMobile…but Telikom’s modems are a useful option, where the service is available……

On the fibre optic cables. NICTA and Dataco seem to be in interminable dialogue. Clearly the high cost of the (Huawei) domestic Kumul cable (price charged for installing and, no doubt the debt service costs) is a major burden for Dataco (especially when it’s down for extended periods thanks to successive earthquake damage – which makes one wonder about the quality of the design/installation); it seems they want to utilise their monopoly control of the international access to cross subsidise the high cost of their domestic cable network, potentially severely undermining the opportunity gained from massive increase in bandwidth provided by the new cable to Sydney. NICTA is trying to determine a more acceptable set of user fees for consumers (business, government and individuals).

Especially, now, with Covid-19 restraining normal economic, social and governance activities, it’s crucial to be able to open up opportunities for e-learning, e-commerce as well as e-theatre and entertainment in a manner that’s affordable for users, especially for public education services. That requires very substantial cuts in costs to consumers, including for government to fund e-education and health services. The ISPs at the moment still seem to access the internet more affordably from satellites than from the cable network, so they’re hesitant to tie up to the new cables at least until pricing is markedly more competitive.

The ball is very much in the Government’s court, but government and its various entities (authorities & SOEs) need to be ready to share information (including details of their own contracts and financing arrangements), cooperate and be fully accountable to the public that they ostensibly serve.

Thanks Amanda and team for another comprehensive update on data prices in PNG, it is interesting to see how things are unfolding.

It certainly does pay to shop around the various platforms to access both Digicel and Telikom bandwidth. We have found that topping up prepaid plans via Digicel online top-up website provide options not available on the USSD menu. Both Digicel and Telikom offer 30 day 50GB @ K230 which equates to 46t per megabyte. Anyone with a smart phone should probably check the websites – especially Digicel as their 30 day USSD options do not compete with the website option. These prices have not changed either all year.

Satish makes a good point, too, about competition. In fact many of the “Digicel” towers around PNG were wholly or partly funded by local MPs. It would seem only fair if these assets funded with public funds could somehow co-locate other ISP equipment … even the smaller, local ISPs that are emerging. As well as reducing the amount of unsightly towers around the country it would increase competition and hopefully lower prices. As things stand, in places it’s a little like the govt funding a road and only letting one trucking company use it.

Anyway, let’s see what is around the corner with Elon Musk’s Starlink service. If that lives up to its hype it could be truly disruptive and we might not need towers or submarine cables 🙂

Thanks to you, Picky and Moses for the excellent information.

Thanks for this informative and timely blog, and please continue to update us on prices and coverage of telephony in PNG. Access to digital technology for information is now more important than ever before. Many of my friends in PNG carry two phones, or sometimes one phone with two SIM cards. This is done to take advantage of lower prices offered by BMobile/Telikom where there is coverage and Digicel for regions not covered by Telicom. I am also told that the extensive antenna network that Digicel put up when it first entered the market gave the company a head-start that Telikom has not been able to match. Allowing access to the same antenna-infrastructure at competitive prices by both networks may increase competition and in the process deliver better coverage and prices for the population at large.