This blog post outlines the findings of our new Development Policy Centre Discussion Paper in which we estimate the current degree of misalignment in PNG’s real exchange rate (RER). The RER is defined as the relative cost of tradable in terms of nontradable goods (expressed in domestic currency terms). It is thus a key relative price for any open economy.

PNG’s resource boom has come to an end. Theory suggests that when this happens, the RER should depreciate. However, the kina has depreciated less in comparison to the currencies of many other resource-dependent developing countries. In addition, foreign exchange reserves have fallen from US$4 billion in 2012, to around US$1.7 billion in 2016.

Yet this release of reserves has not sated demand at the current exchange level. In response, the Bank of Papua New Guinea (BPNG) began to ration foreign exchange. Reportedly, the excess demand for foreign currency is about US$1 billion and rising. The rationing has led to a sharp fall in imports in 2015, which reflects the increased difficulty of PNG businesses to source crucial capital goods and intermediate inputs from the rest of the world.

Why is the exchange rate overvalued?

Why did the central bank not allow sufficient real depreciation despite the clear signs of currency overvaluation? In addition to containing inflation and keeping imports affordable, an important reason for this is that the equilibrium real exchange rate (ERER) is unobserved.[1] This means that it is difficult for policy makers to know by how much, even approximately, the RER should fall. While estimates such as a 40% kina overvaluation circulate in the popular press, it is not clear what these are based on.

The purpose of our paper is to inform the ongoing policy debate about the extent to which the kina is currently overvalued. To this end we follow a theory-informed approach to formally estimate misalignment in PNG’s RER. In particular, we use the “single-equation approach”, which we deem the most reliable among the various alternatives. The method estimates the ERER as a function of a set of macroeconomic fundamentals such as, among others, the terms of trade, government consumption, and the net external position. We employ standard time series methods. The sample period is over 1980-2015. In the final step we compute the degree of RER misalignment on the basis of our ERER estimate.

Our results

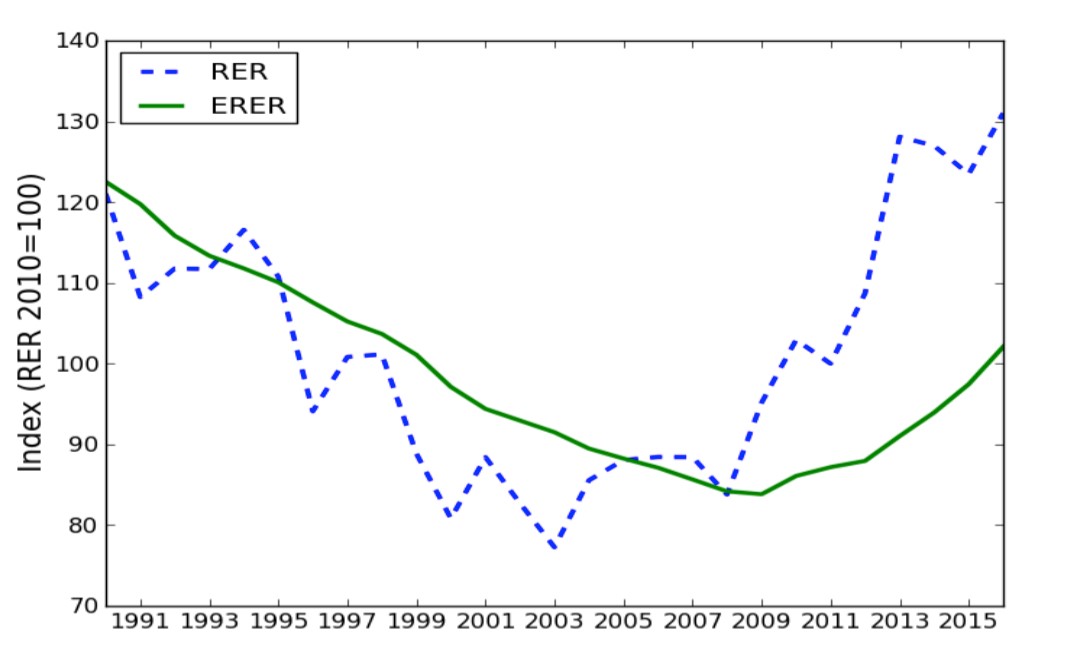

Figure 1 below shows the ERER together with the RER over 1990-2015. From 2007 onwards, an unprecedented resource boom was the catalyst for a rapid economic expansion. As a consequence, the RER appreciated precipitously, which translated into an ever-growing RER overvaluation that continues to the present day.

Figure 1: RER and ERER, 1990-2015

Note: An increase in RER denotes appreciation. Therefore, RER>ERER indicates RER overvaluation.

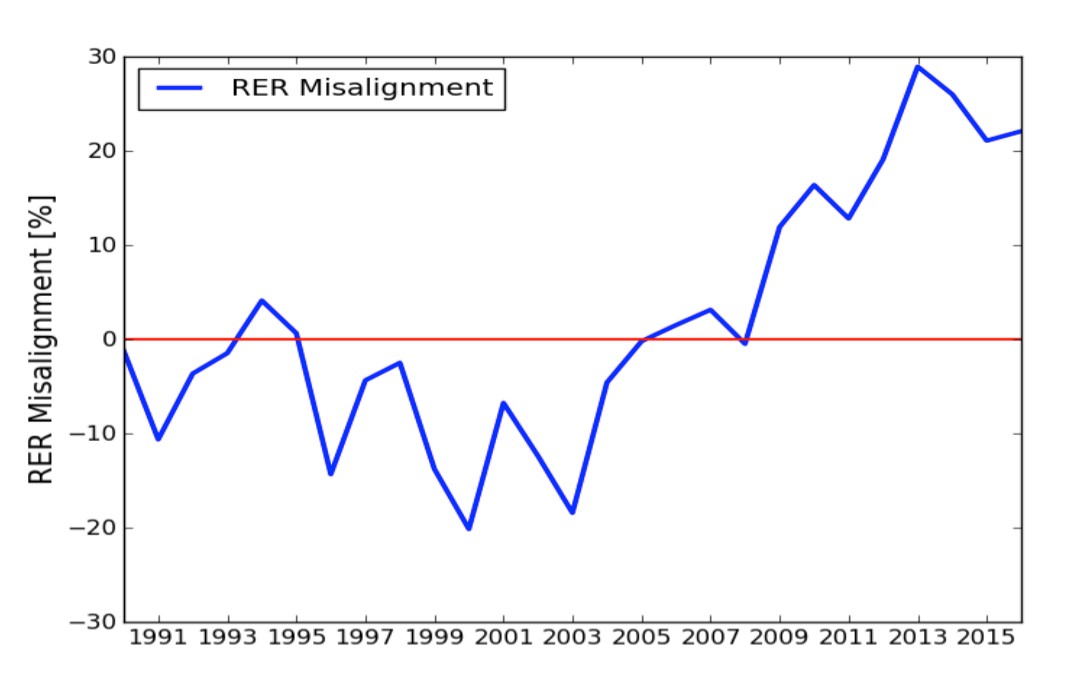

Figure 2 plots the degree of RER misalignment over the same period. Since 2008, real overvaluation has been substantial, never below 12% and almost 30% at the highest level in 2012. In 2015, the last year of the sample period, PNG’s RER was overvalued by about 22%. For 2016, our projections indicate that the RER remains significantly overvalued at around the same level. While the kina has steadily lost its value vis-à-vis US dollar at a rate of about 1% per month since the beginning of 2016, this depreciation will likely be offset by the inflation differential between PNG and its main trading partners (7% versus 1.5%) as well as movements in the ERER fundamentals.

Our results also suggest that the period up until 1994 was characterized by prudential macroeconomic and exchange rate policy. During that time the ERER and RER did not significantly divert from each other implying that the degree of currency misalignment was small. In the following years this quickly changed, however, as fiscal deficits reached unsustainable levels, largely due to falling commodity prices and a sharp decline in foreign aid. In late 1994, the kina was devalued by 12% vis-à-vis the US dollar, which caused the RER to become significantly undervalued. In 1997 the Asian financial crisis and a severe drought adversely impacted on PNG’s economy, which resulted in another nominal exchange rate depreciation of 30% due to serious concerns about the country’s external position. Real undervaluation continued for several more years before the RER adjusted back to its equilibrium level in 2004.

Figure 2: RER misalignment, 1990-2015

Note: Positive values indicate RER overvaluation.

Costs of overvaluation

Our findings have important policy implications. The BPNG should devalue the kina by about 20% in order to restore internal and external equilibrium. Otherwise PNG’s population is likely to pay high economic costs. There is ample empirical evidence that RER overvaluation leads to lower economic growth through resource misallocation. Moreover, the empirical record in Latin America in the 1970s and 1980s suggests that foreign exchange rationing is an ineffective tool to maintain the exchange rate and international reserves, as black markets will eventually develop. Parallel markets entail additional economic costs as they encourage rent-seeking behavior and worsen the fiscal position due to lower seigniorage and tariff revenues. Ultimately a currency crisis might ensue as economic agents are incentivized to divert export receipts away from official channels. It is in the hands of the central bank to prevent such costly and harmful outcomes.

Rohan Fox is a Research Officer at the Development Policy Centre. Marcel Schröder is a Lecturer in Economics in the University of Papua New Guinea School of Business and Public Policy, under the ANU-UPNG partnership.

[1] The ERER is defined as the value of the RER which attains both internal and external balances, taking as given sustainable values of all the relevant variables. Internal balance prevails when nontradable good and labor markets clear. External balance refers to a situation where the country’s external position is on a “sustainable” path.

there is enough usd in the PNG economy for imports, the problem is that a few large companies brought usd onshore in 2008 to 2012 at time when the kina was very strong.

in 2012 they only got 2 kina for a usd

they were ramping up for the expectation of the LNG boom enriching PNG consumers.

now they are repatriating there dividends which has put pressure on the supply of FX

while Exxon has a clear path to recoup it’s investment because it exports gas and gets paid overseas.

Digicel, Toyota etc have a lot of Kina but can’t buy the usd to pay back there investment

Thanks Marcel.

Good to have the feedback. Good to discuss this important issues.

My intuition also is that welfare improving outcomes at the aggregate level are possible with an economic modelling approach that excludes the resource sector. This would be similar to trying to understand economic welfare more broadly in PNG. My strong view is that GDP is a particularly poor measure of economic welfare in PNG given the very dualistic nature of the economy. My preference for measuring economic welfare would be a comprehensive social welfare function approach with distributional weightings (so possibly breaking PNG’s formal, informal and subsistence economy into three elements with very strong distributional weightings for the poor – I applied a SWF with distributional weightings approach to my evaluation of World Bank projects in the Southern Highlands of PNG as part of my honours thesis in 1983). A simpler but still difficult alternative is mapping real household disposable income (in line with the Sarkozy-Stiglitz Commission looking for a better measure other than GDP). This information is not available in PNG. A further fall-back is something like a GNI per capita figure but once again that information is not available for PNG.

The best solution given limited statistics in PNG is excluding the resource sector. The resource sector is primarily foreign-owned and generally heavily indebted (70% of the PNG LNG project which has driven GDP growth in recent years is debt-financed). There are some linkages through domestic value added (local employment and contracts as well as government revenues and landowner royalties) but these are actually quite limited. This is why I use non-resource GDP per capita when tracking changes in economic welfare in PNG – it is the best proxy measure available. I’d prefer other measures but the statistics just aren’t available.

In line with a non-resource GDP measure being a better available measure of economic welfare (as resource exports and imports figures are available), an exchange rate equilibrium model which excludes the resource sector is also one that is more likely to indicate a better way the external sector can contribute to economic welfare in PNG. This gets to the heart of the “Dutch Disease” issue for commodity exporters. With a more appropriate equilibrium position for PNG calculated, I agree entirely with your argument that deviations from such an equilibrium value (whether higher or lower) would represent movements away from an optimal position.

We agree entirely that the distributional consequences of such a change are extremely important. There would be clear winners and losers (this has been discussed in earlier blogs). Currently, the millions of cash-croppers and their families in rural areas are clear losers from the existing exchange rate. Unlike in some other Pacific countries, the majority of PNG’s estimated 40% of people that live in poverty are concentrated in rural areas. They are the ones that suffered from the 2015 drought and frosts with inadequate support. Higher incomes in such areas would save lives and create real, sustainable development opportunities. But as you point out, there would be losers in parts of the urban economy (also urban winners for those innovative SMEs seeking to export products, or manufacturers with high levels of domestic value added, or university students getting income from their wantoks in rural areas etc).

One final but important point which I should have mentioned in the initial comment – thank you to colleagues who highlighted this as an issue last Friday. There is great value in determining the equilibrium position. The vital choice then becomes transition path towards such a value. One approach is a slow transition to minimise shocks and the pain of adjustment. Possibly this was BPNG’s planned approach until the extraordinary 17% appreciation in June 2014, the movement away from a floating exchange rate and the stopping of the depreciation against the US dollar in mid-2016. An alternative approach is a sharp adjustment to the new equilibrium level (with many variations around the rate of adjustment). The best path for PNG is probably unknown at this stage as key information required for such a difficult judgement call are currently hidden from public view (such as the true balance sheets of SOEs and how much foreign currency debt is being carried, the actual level of backlog demand for foreign currency) as well as the unknown level of international funding from the IMF and others when the adjustment becomes unavoidable (Mongolia’s external payment difficulties meant it went to an IMF program last week with $US440m in IMF support and up to $US5.5 billion mobilised from other sources).

Cheers

Paul

Great contributions! We need more concrete economic research and analysis with open debate about PNG’s economic policies as generic economic models may not necessarily suit PNG’s conditions. Giving serious thoughts to the issues, researching and openly debate about these matters will bring out the best in research to provide the basis for better policy formulation and implementation to support the vast majority of PNG’s population. Thank you to Rohan & Marcel for the analyses and the commentary from Paul Flanagan is a positive input to the analyses. Great work.

Rohan and Marcel – congratulations on this excellent analysis. PNG needs more of this rigorous research to help inform better policy making in PNG.

A few quick update comments.

First, the latest IMF report (released too late for your work) is a little clearer on its views. Of the three models the IMF uses, its preferred EBA-lite REER model (given quantitative restrictions imposed by the BPNG) is an over-valuation of the Kina by 29% (page 23 of its report). This is close to my earlier estimates of a 30% devaluation being required which was based around returning to the REER of 2006.

Second, in addition to the macroeconomic impacts on growth from the overvaluation of the Kina, there are very significant distributional implications. Essentially, an overvaluation is biased against the millions of rural poor cash croppers (coffee, cocoa etc) and in favour of urban consumers. It is also biased against local production and in favour of imports. These distributional implications are at least as important as any growth implications given GDP is such a poor measure of economic welfare in PNG.

Third, the Kina has actually started to appreciate again since August 2016 on a Trade Weighted Basis according to the latest December monthly bulletin from the central bank (Chart 2). So this is going in the wrong direction.

Fourth, inflationary concerns may not be as serious in PNG as thought earlier in the year. In particular, the decline in food prices following the end of the drought and foolish earlier banning of imported products has led to an actual fall in retail prices over the last 12 months. The central bank probably has more room to move than its suggests.

Finally, and possibly most importantly for policy settings, there is a very interesting issue of how to target external balance in PNG. Most economic models fully include the resource sector. Given the characteristics of PNG’s dualistic economy, I wonder whether the modelling should actually be based on excluding the resource sector? This would lead to an even more competitive Kina exchange rate, and even better development opportunities for the vast majority of PNG’s population. The likely accumulation in foreign exchange reserves would become a de facto Sovereign Wealth Fund (as it did for China).

Once again, well done for the excellent analysis.

Paul Flanagan (PNG Economics)

Hi Paul,

Many thanks for your comment. I fully agree with your second and third point. Also thanks for mentioning the recently released IMF estimates. It’s good to see that theirs are largely in line with ours (in contrast to the ones published in their previous report). Hopefully the mounting evidence of kina overvaluation helps convince the authorities to let the exchange rate move in the right direction soon.

Your last point is interesting. Intuitively, given the lack of government services and transfers to rural areas and how partitioned the PNG economy is, using your approach to equilibrium exchange rate modelling could well lead to welfare improving outcomes at the aggregate level. However, I think more evidence is needed of the economy-wide benefits of an “ultra-competitive” kina. While rural cash croppers would profit from such an exchange rate the urban economy would bear significant costs. This is so because an analysis that excludes the resource sector is likely to suggest an undervalued kina for the urban economy on which the mineral sector has a significant impact. But currency undervaluation is just as harmful as overvaluation since it leads to resource misallocation and builds up inflationary pressures. So it is not obvious to me that leaving out the resource sector will ultimately lead to better outcomes.

Regards,

Marcel