It has been more than a year since the Central Bank of PNG (BPNG) introduced a trading band to its exchange rate on 3 June 2014 with the stated purpose being to address excess bank profiteering on exchange transactions. A trading band is usually used to limit volatility by only allowing trade within a specified exchange rate range. However in PNG’s case, as the bottom of this allowed range was above the at-the-time current trading rate, it resulted in an immediate 17 per cent increase in the exchange rate. Subsequently the exchange rate began to depreciate, but 12 months on, it was still 6 per cent higher than just before the bands were introduced. Sixteen months on, by the end of September, the exchange rate has just dipped below what it was immediately before the band was introduced.

This post looks at what happened to the exchange rates of other resource exporters in the year after PNG introduced its trading bands and makes a comparison.

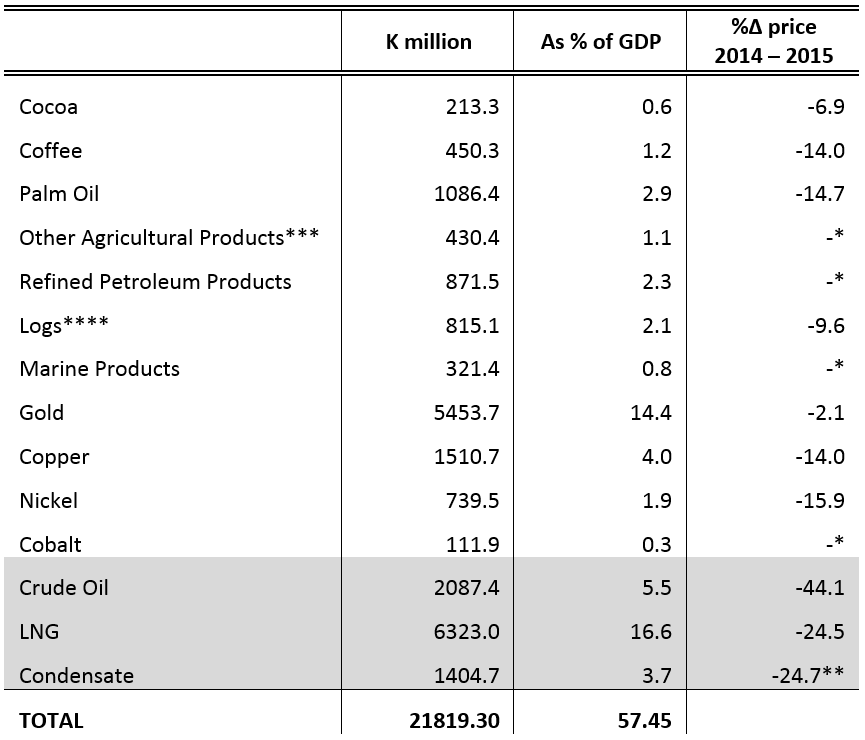

Commodity price shocks disproportionately affect countries that are large commodity exporters through reducing demand for those countries’ currencies. As shown in Table 1 below, Papua New Guinea is very reliant on exports, and particularly on LNG, gold and oil. As shown, oil and oil-related products have fallen sharply.

Table 1: PNG export revenue values, 2014

Sources and notes: Export list from BPNG export data statistics, 2014 GDP estimated using 2013 GDP from World Bank PNG country profile, 2014 GDP growth rate from ADB PNG country economic profile, prices taken from the World Bank commodity price forecasts [pdf]. *No price data for these commodities/commodity groups; **Condensate prices from Ycharts using average prices for 2014 and 2015; ***‘Other agricultural products’ includes tea, copra, copra oil and ‘other’; ****‘Logs’ includes logs and ‘other forest products’.

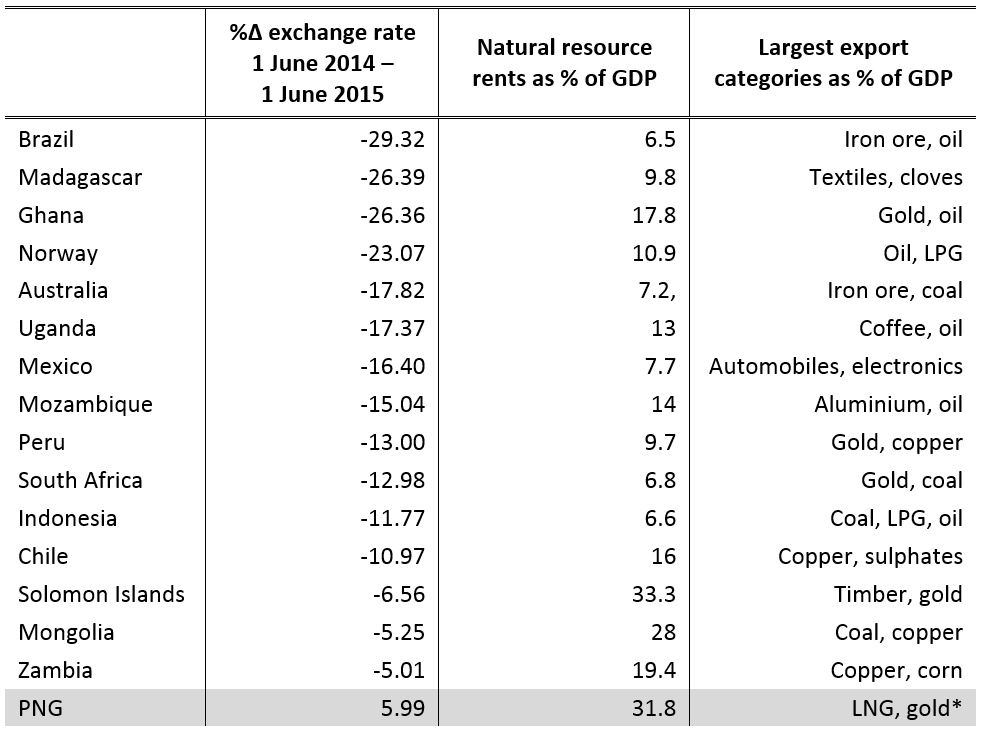

The movement in PNG’s exchange rate over the last year makes it unique amongst similar economies. Table 2 shows the movement of PNG’s exchange rate against the US dollar over the last year, in relation to the movement of the top 15 resource-dependent countries in the world with floating exchange rates. According to the most recent set of World Bank data, natural resource rents made up 32 per cent of PNG’s GDP, making it the second most reliant on resource rents in the world.

As can be seen, all of these countries’ exchange rates fell, except for PNG, whose exchange rate appreciated. For other countries, this reflects the increasing strength of the US dollar in general but also the commodity price fall. For PNG, it shows the influence of the trading bands. It is true that the PNG kina declined in value prior to June 2014 (in particular because of the end of the construction phase of the LNG project) but this should be seen as a natural process interrupted by the June 2014 appreciation. It might also be thought that the strengthening of the currency this year in PNG is due to the commencement of the LNG project, but with low gas prices this has not in fact significantly helped boost the supply of foreign currency. Also note the large depreciations experienced by oil exporters since June 2014.

Table 2: 15 most resource-dependent economies with floating exchange rates, and PNG

Sources and notes: Resource dependency is measured by the ratio of natural resource rents to GDP, as measured by the World Bank Databank. Exchange rates from OANDA datasets using average rates for the months of May 2014 & 2015. Export categories from The Observatory of Economic Complexity datasets, 2012. *PNG export category taken from BPNG export data statistics, 2014.

In summary, for the year after the introduction of trading bands in June 2014, at a time when PNG should have allowed its currency to depreciate to cushion the external price shock, instead the kina was actually allowed to gain in value, ending the period stronger than it began. Although the exchange rate has now fallen to just below its June 2014 level, a year has been lost. To avoid standing out among commodity exporters, a lot more depreciation will be needed.

Rohan Fox is a Lecturer and Research Fellow in the University of Papua New Guinea Division of Economics, and a Research Associate of the ANU Development Policy Centre. This post, the first in a three-part series, is a modified excerpt from a paper presented at the 2015 PNG Update and 2015 Pacific Update. Find the second and third posts in the series here and here.

I guess that the results could of been better. But considering that this is a new tool added to their economy, we can consider it as a promising start. I am sure taht once they get more experience, they will get better results. Does anyone share the same opinion? I would be nice if we could have similar recent situations to compare to.

Thanks Rohan. An excellent blog, highlighting how PNG’s exchange rate could have been used more effectively to deal with the recent fall in international commodity prices. For reasons of international comparability, it is understandable that Table 2 is based on changes relative to the US dollar. In PNG’s case, the relatively small appreciation shown against the USD of 5.99% to 1 June 2015 understates the Kina’s strong appreciation against most of its other trading partners. Its overall trade weighted index (TWI) is still well above its market levels back in June 2014 by about 20% reflecting strong appreciations against the AUD of 34%, the Indonesian Rupiah of 27% and the Malaysian Ringgit of 40%. Of even greater significance for PNG’s international trade competitiveness, PNG’s exchange rate (weighted by trading patterns and relative inflation rates – so the “Real Effective Exchange Rate”) is still at high levels not seen since the late 1980s, and some 60% higher than its levels in the early 2000s. It is this longer term pattern of real exchange rate appreciation that is undermining PNG’s international competitiveness, hurting domestic exporters, reducing incentives for foreign investment as well as failing to act as a shock absorber for commodity price changes.